What’s an efficient credit score rating ranking?

That’s most definitely the one commonest question prospects ask, and the one most repeatedly requested of lenders and credit score rating specialists.

As loads as we’d want to present you an absolute reply to that question, the reality is that it isn’t on a regular basis clear.

So much relies upon upon every the sort of mortgage you’re making use of for, along with the exact lender. Though there are widespread pointers as to what’s credit score rating ranking, each lender has its private regular. And it’s potential that you just simply obtained’t qualify for approval, even must you meet a lender’s credit score rating ranking pointers.

As you’re about to review, the information contained in your credit score rating report may very well be merely as essential as your complete credit score rating ranking. That’s why it’s essential to know as loads as potential about credit score rating scores, and credit score rating mainly, sooner than making use of for a mortgage.

Nonetheless with that acknowledged, we’re going to produce some widespread parameters on what’s taken under consideration credit score rating ranking.

Desk of Contents:

- What’s a Good Credit score rating Ranking?

- Why It’s Important to Have a Good Credit score rating Ranking.

- Your Credit score rating Is Additional Than a Credit score rating Ranking

- How To Get A Good Credit score rating Ranking

What’s a Good Credit score rating Ranking?

Let’s go to the official provide of FICO Scores, myFICO.com.

According to the information they provide, credit score rating scores fluctuate between a low of 300 and a extreme at 850, though they will fluctuate from 250 to 900 for explicit lending courses.

According to their knowledge, credit score rating ranking ranges are as follows:

| Credit score rating Class | Credit score rating Ranking Differ | Chance of Delinquency |

|---|---|---|

| Distinctive | 800 or elevated | 1% |

| Very Good | 740 to 799 | 2% |

| Good | 670 to 739 | 8% |

| Truthful | 580 to 669 | 28% |

| Poor | 579 and reduce | 61% |

Sooner than looking out for an answer to the question, what’s an efficient credit score rating ranking, the “official” reply may very well be 670 or elevated.

Nevertheless it absolutely’s essential to understand that though 670 and above may be what myFICO determines to be credit score rating ranking, interpretation of credit score rating scores is extraordinarily subjective.

Each lender – in any explicit mortgage class – might have its private pointers as to what constitutes good credit score rating.

As an example, one lender might ponder good credit score rating to be 660 and above.

A second might determine 680 or elevated, whereas a third might set the prohibit at 700.

An far more discerning lender might set the sting at 720.

As loads as we’d prefer to say there’s a specific credit score rating ranking fluctuate that determines exactly what’s taken under consideration credit score rating ranking, there’s no definitive reply – not lower than not in all cases.

Get Your Free Credit score rating Report For the time being

Why it’s Important to Have a Good Credit score rating Ranking

Take a look on the desk above, spending a few seconds scanning the “Chance of Delinquency” column. That’s the total trigger credit score rating courses and credit score rating ranking ranges matter to lenders.

Chance of Delinquincy and Curiosity Costs

As you can see, credit score rating scores of 800 or elevated, known as an “Distinctive” have solely a 1% likelihood of delinquency. That is the explanation people who match on this fluctuate are very extra prone to be permitted for nearly any form of mortgage they could apply for. And for the reason that likelihood of delinquency is so low, they’ll moreover get the right charges of curiosity and phrases.

Nonetheless shifting proper all the way down to the “Very Good” class fluctuate, the delinquency payment solely will enhance to 2%. Of us on this credit score rating ranking fluctuate are moreover very extra prone to get any mortgage they apply for. And whereas they won’t get the right fees a lender has to produce, they’ll get one factor very shut. And sometimes they’ll even get top-of-the-line fees on the market, counting on the sort of mortgage.

Nonetheless shifting to the third class, “Good,” uncover that the delinquency payment will enhance to eight%. Though that’s nonetheless an inexpensive payment, it’s not virtually almost pretty much as good as a result of the Distinctive and Very Good courses, the place the likelihood of delinquency is close to nonexistent.

This elevated delinquency payment is the rationale why any person with a credit score rating ranking of 690 – whereas being extraordinarily extra prone to be permitted for the credit score rating requested – pays the following fee of curiosity than any person with a ranking of 760 or 820.

And as you can see, the delinquency payment jumps dramatically throughout the “Truthful” and “Poor” credit score rating courses. Since extreme delinquency fees can merely flip into defaults, lenders will not be going to solely price elevated fees, nonetheless they’re moreover extra prone to say no credit score rating capabilities for debtors in these ranges.

Your Credit score rating is Better than a Credit score rating Ranking

Most prospects naturally focus their consideration on their credit score rating scores. It’s develop to be a convention because of your ranking represents your credit score rating profile in a single amount. In addition to, since it is a amount, it’s measurable. If it rises, you’re headed within the appropriate course. However when it falls significantly, it should most likely have an impact in your non-public funds.

Nonetheless whereas lenders might focus rigorously on credit score rating scores, it’s not on a regular basis the whole picture.

Credit score rating scores are merely a numeric illustration of your complete credit score rating profile. Nonetheless lenders may also do a drill down into the small print of your credit score rating.

Historic previous of Chapter

As an example, let’s say your credit score rating ranking is 690 and properly contained in the fluctuate of credit score rating scores accepted by a particular lender you have to make an utility with. However when your credit score rating report reveals you had chapter 5 years previously, the lender ought to decline your utility. If the lender has a “no chapter” protection, they obtained’t approve your utility, even must you meet the credit score rating ranking pointers.

Historic previous of Late Funds

Totally different lenders may be far more explicit. As an example, must you had a 60-day late payment contained in the earlier two years, they could decline your utility, although your credit score rating ranking meets the stated requirements. This may occasionally happen because of lenders might arrange requirements, equal to no more than two 30-day late funds contained in the earlier two years. As a result of 60-day late payment, your utility won’t be permitted even with what’s determined to be an applicable credit score rating ranking.

It’s not on a regular basis potential to know what the secondary credit score rating requirements is sooner than making use of for a mortgage. Nonetheless it could be worth it to do some investigating sooner than submitting a credit score rating utility, considerably if you’ve obtained any of the above delinquency knowledge exhibiting in your credit score rating report.

Strategies to Get a Good Credit score rating Ranking – Or at Least a Greater One

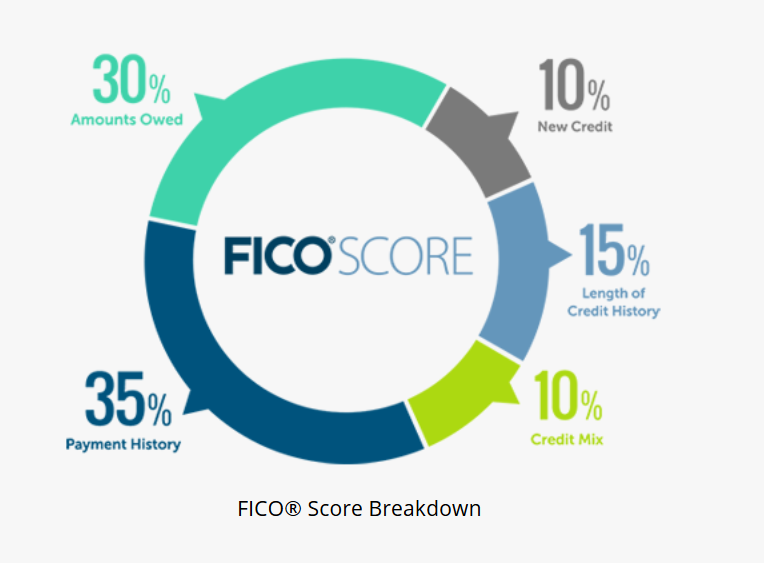

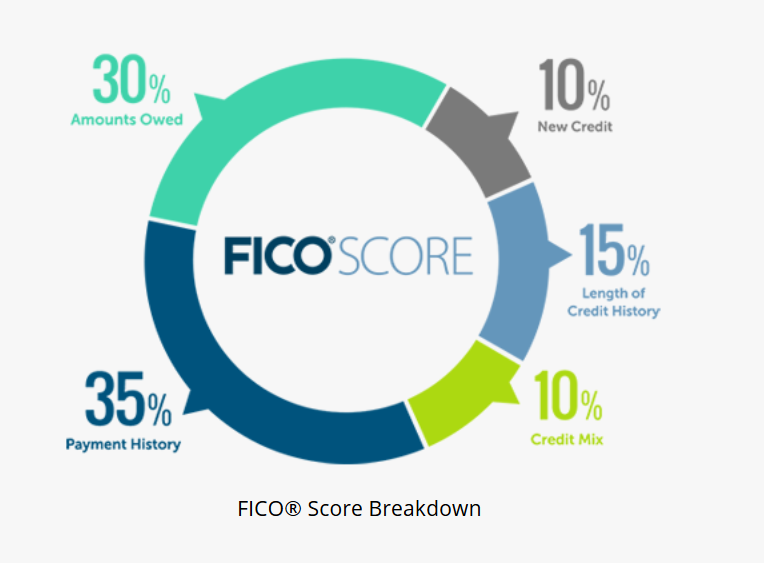

As quickly as as soon as extra, turning to the official provide, in accordance with myFICO.com, your credit score rating ranking is calculated based on the following 5 elements.

Let’s deal with each of these elements individually, since each performs a component in determining your credit score rating ranking.

Payment Historic previous

This important single subject, at 35%. The plain most interesting strategy to make this subject work in your favor is to make your total funds on time.

If you do have a historic previous of delinquent credit score rating, take steps to reinforce it. First, get a replica of your credit score rating report and seek for any knowledge which can be inaccurate to have the ability to dispute it with the collectors and, if essential, immediately with the credit score rating bureaus.

If you’ve obtained late balances or collections, pay them off as shortly as potential. Though the opposed knowledge will keep in your credit score rating report, a paid past-due or assortment is on a regular basis larger than an open, unpaid one. As properly, if you pay it off, you’ll be in your strategy to having it step-by-step age-out of your credit score rating ranking (older past-due and assortment accounts have a lot much less have an effect on than extra moderen and current ones).

Portions Owed

This one could be most likely essentially the most difficult for a lot of prospects. Principally, it’s the amount you owe on loans and financial institution playing cards compared with each the extreme credit score rating prohibit or the distinctive mortgage stability. That’s repeatedly often known as the credit score rating utilization ratio.

It’s sometimes actually useful that you just simply maintain it at decrease than 30% to maintain up good credit score rating (as an illustration, you owe decrease than $6,000 on credit score rating limits and distinctive mortgage balances of $20,000 or further). Nonetheless fantastic or distinctive credit score rating is usually reserved for these with a ratio below 10%. On the reverse end of the spectrum, a credit score rating utilization ratio of 80% or further is taken under consideration a predictor of future default.

To boost this ratio, pay down your loans and financial institution card balances whereas preserving each open and full of life. That may present assist to to reinforce your credit score rating utilization ratio, and likewise your credit score rating ranking.

Dimension of Credit score rating Historic previous

Though solely 15% of your credit score rating ranking calculation, it should most likely nonetheless be important. Your credit score rating ranking calculates the widespread age of all your credit score rating accounts. The longer the widespread, the upper your credit score rating ranking. A median credit score rating historic previous over 5 years will fetch the following ranking than one decrease than three years. Nonetheless solely time can improve this subject.

New Credit score rating

New Credit score rating is rigorously related to Dimension of Credit score rating Historic previous. In the end, new credit score rating reduces the widespread age of your credit score rating accounts. An extreme quantity of latest credit score rating can injury every the New Credit score rating and Dimension of Credit score rating Historic previous elements, which collectively characterize 25% of your credit score rating ranking.

To get the upper hand on this class, apply for model new credit score rating solely sparingly. For a lot of prospects, that can probably suggest no a number of or two new credit score rating sources per yr.

That’s moreover the category the place inquiries come into play. The credit score rating scoring fashions ponder inquiries to be a opposed subject since they level out you’re actively in search of new credit score rating. And since new credit score rating is a attainable hazard, inquiries can lower your credit score rating ranking if solely by a few components each.

Fortunately, inquiries age-out after only a few months. For that trigger, be careful to make use of for model new credit score rating no more than every few months – even must you don’t accept all the credit score rating you’ve utilized for.

Credit score rating Mix

Fortunately, this subject accounts for lower than 10% of your credit score rating ranking calculation. Nonetheless must you’re making an attempt to increase your credit score rating ranking to the following credit score rating class, it shouldn’t be ignored.

The credit score rating scoring fashions give further favorable consideration to those with a mix of credit score rating. The simplest scoring have an effect on will most likely be for a lot of who’ve a mortgage, an auto mortgage, and quite a lot of different financial institution playing cards. It’s an indication that while you possibly can responsibly deal with quite a lot of credit score rating varieties, you’re not too intently reliant on anybody kind.

On the reverse end of the spectrum, in case your credit score rating report reveals 5 open credit score rating traces, and all 5 are financial institution playing cards, this subject will work in opposition to you. It’s an indication you’re relying too intently on a single credit score rating kind, and presumably the riskiest one at that.

In case your credit score rating report reveals too a lot of the same sorts of financing, mix it up with a particular kind. Having an auto mortgage alongside quite a lot of financial institution playing cards is a powerful mix.

So, What’s a Good Credit score rating Ranking?

Hopefully, you can acknowledge why we advocate in opposition to generalizing about what’s taken under consideration credit score rating ranking. Whereas there are undoubtedly some unfastened pointers that may present you a troublesome idea, the specifics are the place it should get a bit fuzzy.

It would not matter what you be taught or contemplate to be the standard of wonderful credit score rating scores, on a regular basis keep in mind it relies upon upon the foundations set by each explicit individual lender. Uncover out what these credit score rating ranking pointers are, along with any component elements like major derogatory elements or important delinquencies.

Armed with that knowledge, you’ll dramatically enhance the likelihood of being permitted for regardless of financing you apply for, and at the easiest payment. In between once in a while, do regardless of it is important to do to maneuver your credit score rating ranking as a lot as the following class. It might be the excellence between paying the following fee of curiosity and a lower one, and sometimes between approval and denial of your utility.

Related posts

Subscribe

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating