.credit-score-table td {text-align: center; padding: 2px; border-top: 1px secure #FFF; border-left: 1px secure #FFF; }.verybad { background-color: #da9694; }.harmful { background-color: #fabf8f; }.frequent { background-color: #ffff99; }.good { background-color: #c4d79b; }.verygood {background-color: #00b050; }.fantastic {background-color: #00b0f0; }

My credit score rating restore journey started after I had a credit score rating ranking throughout the 530s. I couldn’t get a financial institution card, to not point out a mortgage mortgage.

That’s after I discussed ample is ample and acquired all the way down to be taught each little factor I’ll about enhancing my credit score rating ranking.

I had fairly a bit to be taught. I started by figuring out what credit score rating ranking fashions really meant by phrases like low credit score rating, trustworthy credit score rating, good credit score rating, and fantastic credit score rating.

Desk of Contents:

- FICO Credit score rating Score Ranges

- How To Get Your FREE Credit score rating Report

- How To Improve Your Credit score rating Score Fluctuate

- 7 Tips to Get a Good Credit score rating Score

- Inaccurate Credit score rating Data Could Be Hurting Your Score

- FICO Score vs. Vantage Score

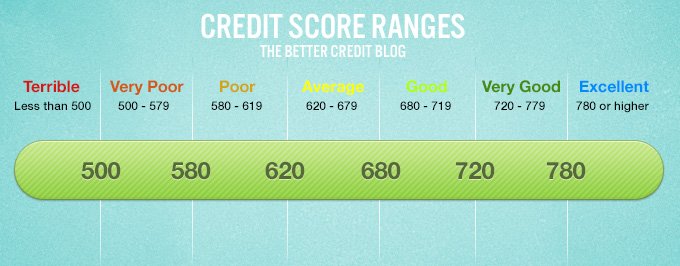

FICO Credit score rating Score Ranges

Proper right here’s straightforward strategies to find out exactly the place your credit score rating ranking falls throughout the fluctuate of FICO scores.

- Superb Credit score rating (780+): With an excellent credit score rating ranking of 780 or bigger you may get the right prices accessible.

- Very Good Credit score rating (720 – 779): On this fluctuate you shouldn’t have any points getting good prices.

- Good Credit score rating (680 – 719): This is usually a good credit score rating fluctuate to be in, nonetheless you gained’t get the right prices on loans or financial institution playing cards.

- Frequent Credit score rating (620 – 679): Your ranking might use some enhancements, nonetheless it’s best to nonetheless have the flexibility to get first charge prices. You can nonetheless qualify for a lot of FHA mortgage loans, as an illustration.

- Poor Credit score rating (580 – 629): A credit score rating ranking on this fluctuate means you’re bigger hazard and would possibly want trouble discovering first charge prices. You’ll moreover get turned down on some credit score rating functions. You could nonetheless get some USDA and VA loans within the occasion you qualify for these packages.

- Very Poor Credit score rating (579 or a lot much less): One thing decrease than 580 signifies that you just’re very extreme hazard for borrowing. You’ll get turned down for almost all credit score rating functions. In case you do get accredited, the charges of curiosity is likely to be staggering. Don’t worry though, this can be mounted!

Learn to Get Your Free Credit score rating Report

If you happen to want to see your latest credit score rating ranking freed from cost, now you will get a free credit score rating report each week from TransUnion, Equifax, and Experian by visiting annualcreditreport.com.

Free weekly research is likely to be accessible by April of 2021 in response to the coronavirus pandemic. After April of 2021, you’ll nonetheless be eligible for one free credit score rating report from all three most important credit score rating bureaus yearly.

You possibly can too monitor your credit score rating by free credit score rating monitoring corporations like Credit score rating Karma or Credit score rating Sesame. These gained’t current your exact credit score rating ranking, nonetheless they’ll give you a terrific approximation based in your value historic previous, credit score rating utilization cost, and combination of accounts.

Actually considered one of your financial institution card accounts might present free FICO scores or free Vantagescore. Confirm on the app or website online to hunt out out.

Get a Free Copy of Your Credit score rating Report

Credit score rating Score Ranges Chart

| Very Poor | Poor | Frequent | Good | Very Good | Superb |

| 579 | 619 | 679 | 719 | 779 | 800+ |

| 578 | 618 | 678 | 718 | 778 | 799 |

| 577 | 617 | 677 | 717 | 777 | 798 |

| 576 | 616 | 676 | 716 | 776 | 797 |

| 575 | 615 | 675 | 715 | 775 | 796 |

| 574 | 614 | 674 | 714 | 774 | 795 |

| 573 | 613 | 673 | 713 | 773 | 794 |

| 572 | 612 | 672 | 712 | 772 | 793 |

| 571 | 611 | 671 | 711 | 771 | 792 |

| 570 | 610 | 670 | 710 | 770 | 791 |

| 569 | 609 | 669 | 709 | 769 | 790 |

| 568 | 608 | 668 | 708 | 768 | 789 |

| 567 | 607 | 667 | 707 | 767 | 788 |

| 566 | 606 | 666 | 706 | 766 | 787 |

| 565 | 605 | 665 | 705 | 765 | 786 |

| 564 | 604 | 664 | 704 | 764 | 785 |

| 563 | 603 | 663 | 703 | 763 | 784 |

| 562 | 602 | 662 | 702 | 762 | 783 |

| 561 | 601 | 661 | 701 | 761 | 782 |

| 560 | 600 | 660 | 700 | 760 | 781 |

| 559 | 599 | 659 | 699 | 759 | 780 |

| 558 | 598 | 658 | 698 | 758 | |

| 557 | 597 | 657 | 697 | 757 | |

| 556 | 596 | 656 | 696 | 756 | |

| 555 | 595 | 655 | 695 | 755 | |

| 554 | 594 | 654 | 694 | 754 | |

| 553 | 593 | 653 | 693 | 753 | |

| 552 | 592 | 652 | 692 | 752 | |

| 551 | 591 | 651 | 691 | 751 | |

| 550 | 590 | 650 | 690 | 750 | |

| 549 | 589 | 649 | 689 | 749 | |

| 548 | 588 | 648 | 688 | 748 | |

| 547 | 587 | 647 | 687 | 747 | |

| 546 | 586 | 646 | 686 | 746 | |

| 545 | 585 | 645 | 685 | 745 | |

| 544 | 584 | 644 | 684 | 744 | |

| 541 | 583 | 643 | 683 | 743 | |

| 540 | 582 | 642 | 682 | 742 | |

| 539 | 581 | 641 | 681 | 741 | |

| 538 | 580 | 640 | 680 | 740 | |

| 537 | 639 | 739 | |||

| 536 | 638 | 738 | |||

| 535 | 637 | 737 | |||

| 534 | 636 | 736 | |||

| 533 | 635 | 735 | |||

| 532 | 634 | 734 | |||

| 531 | 633 | 733 | |||

| 530 | 632 | 732 | |||

| 529 | 631 | 731 | |||

| 528 | 630 | 730 | |||

| 527 | 629 | 729 | |||

| 526 | 628 | 728 | |||

| 525 | 627 | 727 | |||

| 524 | 626 | 726 | |||

| 523 | 625 | 725 | |||

| 522 | 624 | 724 | |||

| 521 | 623 | 723 | |||

| 520 | 622 | 722 | |||

| 519 | 621 | 721 | |||

| 518 | 620 | 720 | |||

| 517 | |||||

| 516 | |||||

| 515 | |||||

| 514 | |||||

| 513 | |||||

| 512 | |||||

| 511 | |||||

| 510 | |||||

| 509 | |||||

| 508 | |||||

| 507 | |||||

| 506 | |||||

| 505 | |||||

| 504 | |||||

| 503 | |||||

| 502 | |||||

| 501 | |||||

| 500 |

Enhancing Your Credit score rating Score Fluctuate

So now you understand the place your three-digit amount falls throughout the credit score rating ranking ranges. If you already have fantastic credit score rating — ranging from 780 to 850 — congratulations.

Your solely job now is likely to be to keep up doing what you’re doing to maintain stellar creditworthiness.

If you’ve acquired wonderful credit score rating, it is doable you may want to work out straightforward strategies to optimize your ranking rather more to appreciate an even-better three-digit amount. Keep finding out to be taught strategies to fine-tune your credit score rating life.

For everyone else, you almost certainly have barely work to do to get right into a higher credit score rating ranking fluctuate.

Like I discussed above, don’t worry in case your credit score rating ranking has parked itself on the lower end of the spectrum. I’ll current you exactly the place to start working to appreciate the right credit score rating attainable.

You can improve your credit score rating ranking in a short time within the occasion you dedicate some time to finding out about how credit score rating restore works.

7 Tips to Get a Good Credit score rating Score

The very very first thing to recollect is that getting an excellent credit score rating ranking takes time.

It’s barely easy to remove detrimental devices out of your credit score rating report and get a higher ranking, nonetheless an excellent ranking is one different story.

Now, assuming you don’t have any detrimental devices in your credit score rating report like late funds or a collections account, let’s get into the additional superior credit score rating conduct you’ll must be taught and put into observe.

For sure all of the steps outlined beneath are based mostly totally on my non-public experience, not random advice I’ve study on the net.

- Have at Least Three Credit score rating Taking part in playing cards nonetheless Solely Use One

- Have at Least One Gasoline or Retailer Credit score rating Card

- Use Your Credit score rating Card nonetheless Certainly not Max It Out

- You Desire a Mortgage Mortgage

- Pay Down All Installment Loans

- Don’t Apply for Loans or Credit score rating Taking part in playing cards for at Least a Yr

- Wait, Wait, Then Wait Some Further

1. Have at Least Three Credit score rating Taking part in playing cards nonetheless Solely Use One

This main step comes absolutely from my very personal experience after experimenting with utterly totally different strategies.

To optimize your credit score rating ranking, it actually works best to have no additional and a minimal of three most important financial institution playing cards.

These enjoying playing cards should have prolonged, good value histories, and low credit score rating utilization (additional on this in step 3).

It’s best to utilize solely thought of considered one of these enjoying playing cards recurrently and simply maintain the other two enjoying playing cards with a $0 stability.

It’s not that you’d be capable to’t ever use the other two enjoying playing cards, nonetheless usually, I desire to carry their balances at zero. This method will maximize your credit score rating ranking.

2. Have at Least One Gasoline or Retailer Credit score rating Card

For the longest time, I resisted getting a retailer card, much like a Macy’s financial institution card, because of I observed no degree in opening a model new credit score rating account just for one retailer.

Nevertheless, now I do know larger. In case you retailer at one retailer fairly a bit, and that retailer provides its private financial institution card, take into consideration making use of. These enjoying playing cards have some good perks much like cash once more or coupons.

Further importantly, a retailer financial institution card can enhance your credit score rating. I can’t doc this, nonetheless I do know getting a Macy’s card — and defending its stability at $0 each billing cycle — boosted my FICO ranking by 20 components.

Merely be sure you don’t buy an extreme quantity of and run up a stability you presumably can’t clear each month. In case you do this, you’ll be chopping into your accessible credit score rating which might harm your credit score rating ranking.

3. Use Your Credit score rating Card nonetheless Certainly not Max It Out

I’m not the type of one who buys each little factor on my financial institution card. I do use thought of considered one of my financial institution playing cards fairly a bit, nonetheless.

I’ve found I need to make use of the financial institution card fairly a bit to get the most effective FICO ranking attainable. The caveat is that it’s best to on no account max out the cardboard. In reality, I wish to advocate you pay it down (or off) every month and on no account get even close to the credit score rating limit.

As a traditional rule, it’s best to aim to carry your credit score rating utilization beneath 25%. In several phrases, while you’ve acquired a financial institution card with an entire credit score rating limit of $1,000, on no account rack up higher than $250 value of costs on the cardboard.

That is the rationale it’s moreover important to have a financial institution card with a extreme limit. As an example, my principal financial institution card has a credit score rating limit of $30,000, and I on no account get even close to 25% utilization.

In case you don’t have a card with a extreme ample limit to keep up you comfortably beneath 25% utilization, give the creditor a reputation and request that they up the credit score rating limit.

4. You Desire a Mortgage Mortgage

You undoubtedly don’t need a mortgage mortgage to have good credit score rating. Nonetheless, if you happen to want to max out your credit score rating ranking, having a mortgage mortgage with good value historic previous is a ought to.

Since a mortgage mortgage is often a relatively large mortgage and tougher to get than totally different installment loans much like an auto mortgage, a mortgage reveals collectors you have been accountable ample alongside together with your credit score rating to get the mortgage throughout the first place.

Trustworthy Isaac Firm, which provides the FICO ranking, recommends you have a mix of assorted sorts of credit score rating accounts. So along with financial institution playing cards and installment loans, a mortgage mortgage is the ultimate piece of the pie to spherical off your credit score rating mix.

I moreover want to remember I didn’t start seeing my credit score rating ranking go up as a result of mortgage mortgage until a couple of 12 months later, so it undoubtedly takes some time.

You clearly shouldn’t take out a mortgage mortgage merely to get an excellent credit score rating ranking. Nevertheless a mortgage mortgage is usually considered to be “good” debt, in that charges of curiosity are comparatively low and likewise you’re financing one factor that usually appreciates in value.

In case you don’t already have a mortgage, it is best to positively restore up your credit score rating report sooner than making use of for a mortgage — assuming you’re ready for homeownership.

5. Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score rating ranking wouldn’t be affected by the balances on my installment loans.

Nevertheless I seen that after I paid off my auto loans and scholar loans, my credit score rating ranking jumped higher than 20 components.

The essential factor proper right here is that it’s best to repay as quite a lot of the mortgage as attainable, if not all of it. The nearer the remaining stability is to zero, the additional it will revenue your credit score rating ranking.

For barely little little bit of perspective, I paid off a $30,000 auto mortgage, one different $20,000 auto mortgage, and scholar loans totaling $11,000. Nearly immediately after I did this, my credit score rating ranking improved.

6. Don’t Apply for Loans or Credit score rating Taking part in playing cards for at Least a Yr

If you’ve paid down your installment loans, I like to recommend you stop making use of for loans and financial institution playing cards altogether. By this degree, it’s best to have numerous financial institution playing cards in your pockets, a couple of paid off vehicles, and a mortgage.

When you’re on this place, there’s really no need to use for additional credit score rating.

By not making use of for credit score rating, you gained’t get any onerous inquiries in your credit score rating report and this helps your credit score rating ranking. If you happen to would possibly need to apply for credit score rating, merely take into consideration the onerous inquiries will preserve in your credit score rating for a couple of 12 months.

As soon as extra, attempt to be in a state of affairs by this degree the place you don’t need anymore credit score rating.

7. Wait, Wait, Then Wait Some Further

You merely have to be affected particular person. Even if you happen to make all the most effective choices, it’ll take some time to see outcomes.

Part of your ranking relates on to the dimensions of credit score rating historic previous. Nevertheless even on additional important credit score rating reporting parts much like your value historic previous and credit score rating utilization ratio, time is your buddy.

That could be very true in case your earlier credit score rating conduct has been questionable. With each passing 12 months, your earlier harmful choices have a lot much less of an impression in your current credit score rating data.

So be affected particular person and proceed making good choices to establish a optimistic credit score rating historic previous, even within the occasion you don’t see fast outcomes.

Keep making your funds on time and make sure you don’t get any detrimental entries like a set account. And let your current credit score rating accounts become old. The older your accounts, the upper your credit score rating ranking is likely to be.

As an example, my oldest financial institution card is 15 years outdated, and my frequent financial institution card is 8 years outdated.

Be taught Further:

- How To Improve a 560 Credit score rating Score

- How To Improve a 620 Credit score rating Score

Could Inaccurate Credit score rating Data Be Hurting Your Score?

The frequent credit score rating ranking for Folks is 703 based mostly on Experian, considered one of many three most important credit score rating bureaus. Experian contributes info to compile your FICO credit score rating ranking.

On the credit score rating ranking fluctuate, 703 is taken into consideration a terrific ranking. Nevertheless it’s not satisfactory to have a full assortment of mortgage choices while you would possibly need to borrow.

Your good credit score rating might use some fine-tuning if you would like a greater credit score rating ranking.

So let’s say you’ve already constructed a terrific credit score rating mix, a terrific value historic previous, and a longtime measurement of credit score rating historic previous as I described above.

If that’s true, it is doable you may be questioning what’s holding you once more from attaining a definite credit score rating ranking?

Inaccurate Credit score rating Histories Are Widespread

Many people on this state of affairs uncover they’ve numerous detrimental entries on their credit score rating research that are not appropriate.

Credit score rating reporting requires a lot of communication between lenders, mortgage servicers, and the three most important credit score rating bureaus.

When you uncover inaccurate credit score rating data in your credit score rating report, you’ll want to get that detrimental entry eradicated as rapidly as attainable so your credit score rating ranking is likely to be all that it could be.

Sadly, if you happen to apply for credit score rating, financial institution card issuers and totally different lenders gained’t care whether or not or not your credit score rating ranking doesn’t really mirror your exact credit score rating hazard. Regardless of how properly you make clear points, the lender will rely upon what myfico says.

The phrases of your new car mortgage or non-public mortgage will mirror this reported credit score rating hazard. In several phrases, you’ll pay bigger charges of curiosity on account of your inaccurately low ranking.

If you’ve labored onerous to establish an prolonged historic previous of on-time funds and accountable credit score rating utilization, these kinds of lending choices are previous irritating!

So eradicating inaccurate credit score rating data out of your credit score rating historic previous is a ought to. Doing this might restore your credit score rating historic previous inside a pair months.

There are a pair strategies to go about it:

- Do It Your self Credit score rating Restore: You can identify the lender who reported incorrect credit score rating data and ask that they proper the fallacious info. I always advocate coping with this in writing.

- Expert Credit score rating Restore: In case you’re the type of one who would barely pay an professional cope with it and easily be accomplished with your complete factor, I like to recommend you strive Credit score rating Saint.

FICO Score vs. Vantage Score

The three most important credit score rating bureaus created the Vantage Score once more in 2006 to compete with Trustworthy Isaac Firm’s FICO credit score rating ranking model. Since then Vantage Score has launched numerous new credit score rating ranking fashions, along with Vantagescore 3.0 and 4.0.

Whereas the Vantage Score has grown additional well-liked and is easier to check, due to free credit score rating monitoring corporations like Credit score rating Sesame, every your FICO ranking and your Vantage Score work to reveal your credit score rating conduct.

The credit score rating ranking ranges are very associated, although Vantage Score does have a category for good credit score rating (800 to 850).

In case you earn an enchancment inside thought of considered one of these credit score rating ranking fashions, you may almost always see the an identical finish end result with the other model, too — notably while you’ve acquired a shaky credit score rating historic previous and have a pair years of labor to appreciate a terrific credit score rating ranking.

Your FICO Score: Merely One Piece of the Puzzle

I’d desire to conclude this publish by offering barely perspective. You may need thought of making an attempt an excellent credit score rating ranking, and within the occasion you do I like to recommend you go for it.

Nevertheless there’s additional to your non-public finance life than good credit score rating. Fully totally different lenders take into consideration requirements aside out of your credit score rating historic previous if you happen to apply for a mortgage or a financial institution card.

Your debt-to-income ratio, as an illustration, might disqualify you for a couple of of the best financial institution playing cards and mortgage decisions. This ratio measures how properly you’re able to pay your current funds with the income you’re bringing in.

Your employment historic previous might matter to some lenders, too. Just like with the dimensions of credit score rating historic previous, an prolonged employment historic previous works in your favor.

In case you’re employed to create basically probably the most regular non-public finance life attainable, your FICO ranking (and your Vantage Score) will fall into place, and likewise you’ll carry on the prime of the credit score rating ranking fluctuate.

Credit score rating Sources:

- What Impacts Your Credit score rating Score?

- Does Being an Authorized Shopper Help Your Credit score rating Score?

- Can a Enterprise Credit score rating Card Harm Your Non-public Credit score rating Score?

- 10 Credit score rating Hacks to Improve Your FICO Score

- How Eviction Can Affect Your Credit score rating Score

- How Marriage Can Affect Your Credit score rating Score

- Quick Rescoring Can Improve Your Credit score rating Score

- Comfy Inquiry vs. Arduous Inquiry

- How Unpaid Medical Funds Affect Your Credit score rating

- What Does Worthwhile the Lottery Indicate for Your Credit score rating Score?

- How To Study and Understand Your Credit score rating Report

Related posts

Subscribe

* You will receive the latest news and updates on your favorite celebrities!

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating