Have you ever ever ever puzzled why what credit score rating score is required to buy a house is such a popular matter amongst homebuyers?

It’s not almost whether or not or not or not you’ll be authorised for a mortgage to buy the house of your various. Merely as obligatory, it’s about how quite a bit you’ll pay for that dwelling every month.

Your credit score rating scores are a major part of the calculation that may determine what price of curiosity you’ll pay in your mortgage, alongside along with your functionality to even be authorised.

Nevertheless other than the speed of curiosity, your credit score rating score can also impact one different obligatory part of your month-to-month value, which is any mortgage insurance coverage protection which can be required by the lender to make the mortgage.

While you’ve be taught this textual content, you’ll have all of the motivation needed to position inside the time and effort to maximise your credit score rating score to buy a house. Get it correct, and it will possibly prevent your self 1000’s of {{dollars}} yearly, and tens of 1000’s of {{dollars}} over the lifetime of your mortgage.

Desk of Contents:

- What Credit score rating Ranking Do You Need To Buy a Dwelling?

- The Affect of Your Credit score rating Ranking on the Curiosity Cost You’ll Pay

- The Private Mortgage Insurance coverage protection Concern

- Bettering Your Credit score rating Ranking Sooner than Making use of For A Mortgage

What Credit score rating Ranking Do You Should Buy a Dwelling?

Credit score rating scores can range between a low of 300 to a extreme of 850. If you happen to occur to’re making use of for mortgage financing, you’ll wish to fulfill a minimal credit score rating score requirement primarily based totally on the sort of mortgage you’re making use of for.

There are 5 main fundamental mortgage packages, each with their very personal credit score rating score requirements.

Credit score rating Ranking Needed In line with Mortgage Type:

- Typical: With a typical dwelling mortgage, the minimal is commonly 620, nonetheless it is likely to be bigger in case you’re shopping for a visit dwelling or an funding property.

- FHA: With a typical down value of three.5% the minimal score is often 580. Nevertheless in case you make a down value of 10% or further, FHA will enable a credit score rating score as little as 500.

- VA: The Veterans Administration doesn’t impose a minimal credit score rating score. Nonetheless, lenders will often set a minimal credit score rating score of 620, though some will go as little as 580.

- Jumbo: These are for greater mortgage portions on higher-priced properties. Since they’re issued by private sources, often banks, credit score rating scores will fluctuate with each explicit individual program. 620 is extra prone to be completely the minimal, nonetheless many may set a greater threshold, like 660 and even 680.

- USDA: Like VA mortgages, USDA mortgages don’t have a set minimal credit score rating score. Nonetheless, to get a standard approval – which is the best to qualify for – the minimal credit score rating score is 640. Lower scores are permitted beneath certain circumstances, and with required documentation.

Second mortgages, dwelling equity loans and residential equity traces of credit score rating (HELOCs) are issued by banks and credit score rating unions. Each set their very personal credit score rating score minimal.

Whereas it’s doable you could possibly get secondary financing with a score as little as 620, it’s further seemingly the minimal will doubtless be bigger, like 660 or 680, on account of secondary financing is riskier to lenders than first mortgages.

The Affect of Your Credit score rating Ranking on Curiosity Costs

Inside the earlier half, we talked about minimal credit score rating scores to qualify for a mortgage. These score thresholds test with the minimal score at which your mortgage is extra prone to be authorised.

Assuming you on the very least meet the minimal score requirement, the exact stage of your credit score rating score can have a major affect on the speed of curiosity you’ll pay in your mortgage.

That may be very true of ordinary mortgages, jumbo mortgages, and secondary financing. Each contains what’s usually referred to as tiered pricing, which is to say your mortgage cost will doubtless be determined by a mixture of issues.

These will embody your loan-to-value ratio (the amount of the mortgage divided by the property price), the sort of mortgage (fixed or adjustable), and your credit score rating score.

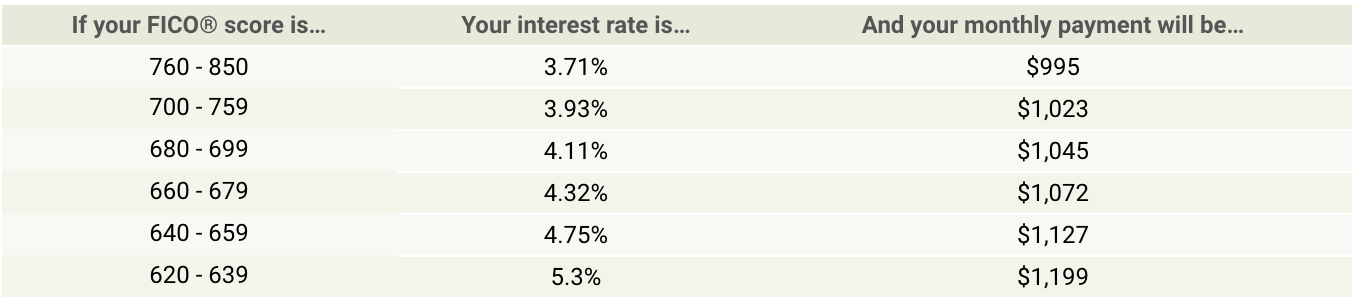

In line with myFICO.com, charges of curiosity and month-to-month funds on the similar mortgage amount can fluctuate significantly at completely completely different credit score rating score ranges (expenses current as of three.24.2020):

In making an attempt on the screenshot above, you might even see that an applicant with an excellent credit score rating score of 630 will pay larger than 1.5 components bigger on the pace than any person with a credit score rating score of 800.

That will translate proper right into a distinction inside the month-to-month value of virtually $200, or $2,400 per yr. Over 30 years, the excellence will doubtless be a staggering $72,000.

As you could inform, getting a mortgage with a poor credit standing can really affect the sum of cash you owe on the overall lifetime of the mortgage.

Nevertheless the place credit score rating scores are concerned, charges of curiosity aren’t the one worth they may impact.

The Private Mortgage Insurance coverage protection Concern

Typical and jumbo mortgages require that you simply simply pay private mortgage insurance coverage protection (PMI) anytime you make a down value of decrease than 20% of the acquisition worth of a home, or in case you refinance your individual house in an amount that exceeds 80% of the property’s appraised price.

PMI is to not be confused with mortgage life insurance coverage protection, which pays off the mortgage upon the demise of the home proprietor. As an alternative, PMI pays the mortgage lender if the home proprietor defaults on the mortgage. Though it doesn’t pay the entire amount of the mortgage steadiness, it pays a share that lowers the environment friendly loan-to-value on the property for lending features.

As an example, a mortgage that equals 95% of the value of the securing property may have a PMI requirement of 30%, which reduces the environment friendly loan-to-value proper all the way down to about 68%. Must the borrower default, the lender will doubtless be extraordinarily extra prone to recuperate the entire amount of the superb mortgage steadiness from a mixture of the sale of the property and the insurance coverage protection paid by the PMI provider.

PMI is principally an insurance coverage protection protection paid by the borrower that offers the lender an inducement to approve a mortgage which can in every other case be thought-about too harmful.

PMI Occasion with Two Completely completely different Credit score rating Scores

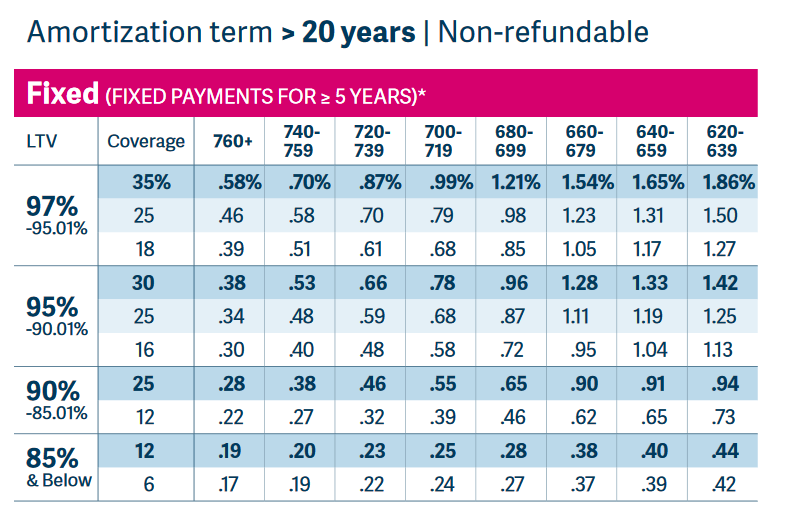

Like charges of curiosity, PMI expenses are carefully influenced by your credit score rating score. The subsequent cost screenshot from MGIC, one in every of many enterprise’s most distinguished PMI suppliers, clearly displays the affect credit score rating scores have on the premium you will pay for the safety:

The screenshot displays the annual premium elements charged on a 30-year fixed cost mortgage primarily based totally on eight completely completely different credit score rating score ranges.

Taking the 95% – 90.01% LTV range at 30% safety, uncover that the annual premium concern for any person inside the 740 to 759 credit score rating score range (prime row) may have an annual premium concern of .53%, whereas any person inside the 660 to 679 score range may have a component of 1.28%.

Proper right here’s how quite a bit each will add to your month-to-month value on a home, assuming a 30-year mortgage for $300,000:

- 740 to 759 credit score rating score range: $300,000 X 0.53/100 = $1,590 per yr, or $132.50 per 30 days.

- 660 to 679 credit score rating score range: $300,000 X 1.28/100 = $3,840 per yr, or $320 per 30 days.

The borrower with a lower credit score rating score may have a greater month-to-month value by $187.50, merely from PMI. On an annual basis, that may add $2,250 to the value of proudly proudly owning the home.

As you might even see, a lower credit score rating score can worth you twice within the case of a mortgage. The first is inside the sort of a greater price of curiosity and month-to-month value on the mortgage itself, whereas the second is from a greater premium for PMI.

Truly, a low credit score rating score can add 1000’s of {{dollars}} per yr to the value of proudly proudly owning a home, so having a superb credit score rating score can stop 1000’s of {{dollars}} per yr by yourself house mortgage.

Bettering Your Credit score rating Ranking Sooner than Making use of for a Mortgage

While you discover the affect your credit score rating score may have in your month-to-month mortgage value, it is best to make every effort to reinforce your credit score rating score sooner than making use of for a mortgage.

Monitor Your Credit score rating

If you happen to occur to’re not already doing so, you should be monitoring your credit score rating score often. You presumably can usually do this with out value by modern free credit score rating score suppliers like Credit score rating Karma and Credit score rating Sesame. Nevertheless it’s seemingly you already have entry to your credit score rating scores by banks and credit score rating unions.

Many now current them as a free service while you’ve acquired a deposit account or a financial institution card with that institution. Uncover out the place your score is true now, and begin monitoring it between now and the time you apply for a mortgage.

If you happen to occur to don’t identical to the score you might need, there’s hundreds you’ll be able to do to reinforce it.

Get a Copy of Your Credit score rating Report

First, get a reproduction of your official credit score rating experiences from all three credit score rating bureaus – Experian, Equifax, and TransUnion. You’ll need all three on account of mortgage lenders entry your credit score rating data from each, so that you simply’ll want to be making an attempt on the same credit score rating experiences your mortgage lender will.

Fortunately, you’ll get a free copy of your credit score rating experiences from Annual Credit score rating Report.com. It’s the one provide formally authorized to give you a reproduction of each of your three credit score rating experiences (there’s one issued by each of the three bureaus).

After you’ve got it, do an intensive evaluation of your credit score rating report. Pay shut consideration to any derogatory data. That will embody late funds, past-due balances or collections, or approved data, like bankruptcies or judgments.

Get Your Free Credit score rating Report Within the current day

Dispute Unfavourable Data

There’s not quite a bit you’ll be able to do about bankruptcies or judgments since they’re a matter of public report.

Nevertheless in case you see any detrimental data in your credit score rating report that you simply simply think about to be in error, file a correct dispute with that creditor. If you’ll get the information eradicated or corrected, which you usually can in case you current a reasonable clarification supported by documentation proving your stage, your credit score rating score will improve with each detrimental entry that’s eradicated.

You most likely have any past-due balances or assortment accounts, pay them off immediately. Although they’ll keep in your credit score rating report for numerous years, a paid account is on a regular basis increased than an open one. Merely paying off the stableness owed on such an account can improve your credit score rating score numerous components.

Lower Credit score rating Utilization

One in every of many largest elements which can be weighing down your credit score rating score is credit score rating utilization. It’s the amount you owe on loans and financial institution playing cards compared with each the extreme credit score rating limit or the distinctive mortgage steadiness.

As an example, let’s say you might need complete credit score rating limits and genuine installment mortgage balances of $40,000 (on presently full of life loans), and in addition you owe $12,000 collectively. Your credit score rating utilization ratio is 30%, or $12,000 divided by $40,000.

30% is taken under consideration to be the ratio at which credit score rating utilization begins to have a constructive impression in your credit score rating score. It is best to work to lower the portions you owe to below 30%. The higher the ratio is, the lower your credit score rating score will doubtless be.

At 80% or further, your credit score rating utilization ratio is taken under consideration to be a major detrimental concern. Decreasing it’s doubtless one of many best credit score rating enchancment strategies you could make use of.

So, What Credit score rating Ranking Do You Need To Buy A Dwelling?

As you might even see, most likely essentially the most obligatory strategies you have to use to reinforce the affordability of the next house you buy is to reinforce your credit score rating score.

Though there are positively certain minimal credit score rating scores to buy a house, you don’t want to go into the making use of course of with merely the minimal.

Truly, you shouldn’t even go in with the everyday credit score rating score to buy a house. If you happen to occur to truly want to keep your month-to-month value to an absolute minimal, do irrespective of is important to get the perfect credit score rating score you could.

If you happen to occur to’re a first-time homebuyer, you’re most probably going to buy a house with a minimal down value. And in case you do, you’ll must pay PMI. That being the case, a low credit score rating score will result in a greater mortgage value itself, along with on the PMI premium.

Spending some time and effort to reinforce your credit score rating score is doubtless one of many best long-term investments you can too make. And in case you’re already in your own home and making an attempt to refinance, you have to use the similar strategies spelled out on this text to reinforce your credit score rating score for a model new mortgage. The similar tips utilized – the higher your credit score rating score is, the lower your price of curiosity, PMI, and month-to-month value will doubtless be.

You owe it to your self to make the extra effort.

Related posts

Subscribe

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating