What credit score rating score is required to buy a vehicle? That question is expounded to anyone who’s making an attempt to buy a vehicle, nonetheless significantly people who fall into the frequent or below-average credit score rating score ranges.

The upper your credit score rating score is, the additional decisions you’ll have with charges of curiosity.

Nonetheless while you’ve received a lower score, you’ll each wish to improve it or use an alternate financing method that we’ll cowl in a while this text.

Nonetheless let’s start by discussing the basics of a credit score rating score wished to buy a vehicle.

Desk of Contents:

- What Credit score rating Ranking Is Needed To Buy a Automotive?

- What’s a GOOD Credit score rating Ranking To Buy a Automotive?

- What You Can Do to Improve Your Credit score rating Ranking for a Automotive Mortgage

- Discover ways to Get a Automotive Mortgage Approval with a Unhealthy Credit score rating Ranking

What Credit score rating Ranking is Needed to Buy a Automotive?

Certainly one of many components that make what credit score rating score is required to buy a vehicle a bit refined is that the auto financing enterprise is slightly extra numerous than totally different types of loans, like mortgage lending.

In that enterprise, most loans are purchased to monumental mortgage companies, like Fannie Mae, Freddie Mac, and Ginnie Mae. Auto financing is completely completely totally different. There are an entire lot of auto mortgage lenders, from banks and credit score rating unions to financing corporations. For that trigger, the credit score rating score wished to buy a vehicle is troublesome to pinpoint precisely.

Normally speaking, you have to be succesful to get prime financing with a credit score rating score in a minimal of the 650 to 660 fluctuate. Many credit score rating unions and some banks make prime financing obtainable at scores that low. Naturally, the higher your credit score rating score, the lower your fee of curiosity will in all probability be.

Top-of-the-line financing preparations will usually begin between 680 and 700. Nonetheless for the very lowest charges of curiosity attainable, a credit score rating score of a minimal of 720 or 750 may be required. As soon as extra, all of it relies upon upon the lender.

In case your credit score rating score falls beneath the 650/660 fluctuate, you’ll fall into the subprime mortgage class. Within the occasion you do, likelihood is you may be charged double-digit charges of curiosity. And in case your score is successfully beneath that modify, like 550 or beneath, you’ll be on the mercy of a lender chosen by the vendor. Charges of curiosity on that form of financing can pretty really be throughout the map.

What’s a Good Credit score rating Ranking to Buy a Automotive?

The credit score rating score wished to buy a vehicle isn’t practically a mortgage approval. Merely as very important, it has an enormous impression on the velocity you’ll pay in your mortgage as quickly because it’s authorised.

Since a low credit score rating score is an enormous predictor of mortgage delinquency and default, a lender will price the subsequent worth to offset that risk. In opposition to this, the higher your score, the lower your fee of curiosity will in all probability be, on account of diminished risk.

To get an considered how loads distinction credit score rating scores might make with a vehicle mortgage, we’ve turned to the availability of FICO scores themselves, myFICO.com.

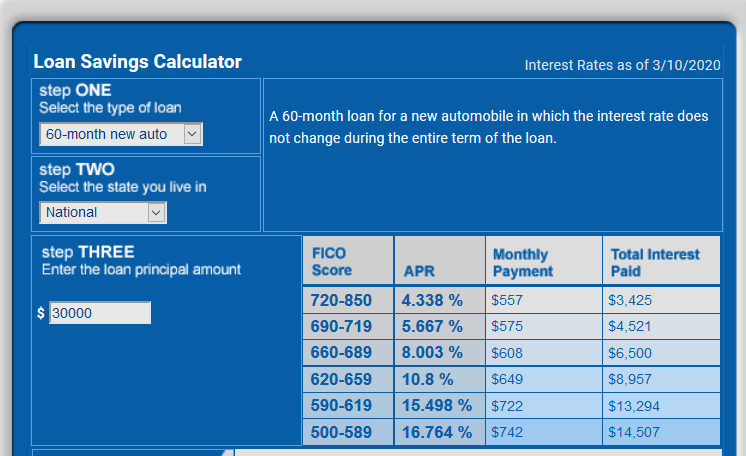

The screenshots beneath are from their Mortgage Monetary financial savings Calculator, that permits you to run diverse mortgage eventualities for every vehicle loans and mortgages, based mostly totally on completely totally different mortgage portions, phrases, and credit score rating scores.

The first screenshot reveals the impression of credit score rating scores on a $30,000 mortgage for a mannequin new vehicle. Using a time interval of 60 months, you presumably can see the month-to-month funds and full curiosity paid for six completely totally different credit score rating score brackets:

Uncover that the very best FICO Ranking bracket, 720 to 850, has the underside APR at 4.338%. That results in a month-to-month price of $557, with $3,425 in full curiosity paid over the lifetime of the mortgage.

Nonetheless drop all the best way all the way down to the fourth FICO Ranking bracket, at 620 to 659, and the speed of curiosity rises to 10.8%. That results in a month-to-month price of $649, with $8,957 in full curiosity paid over the lifetime of the mortgage.

Not solely is the speed of curiosity on this score bracket virtually 6.5 proportion elements bigger, nonetheless the month-to-month price could be further by $91. Which suggests the annual worth of financing the mortgage will in all probability be bigger by $1,092, or $5,460 over the lifetime of the mortgage.

Used Cars: Comparable State of affairs

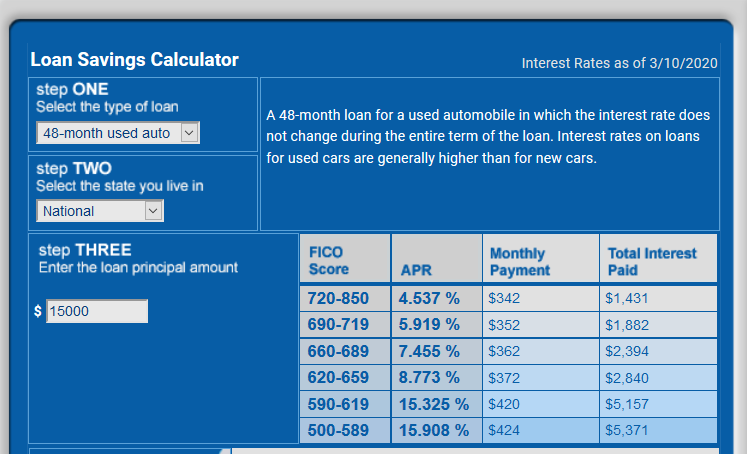

The credit score rating score/interest-rate/month-to-month price connection is comparable with used automobiles. Throughout the occasion beneath, we ran a comparable state of affairs, apart from it entails a used vehicle with a $15,000 mortgage amount and a 48-month time interval:

As quickly as as soon as extra, for many who check out the best line for the very best FICO Ranking fluctuate, 720 to 850, the APR is 4.537% – which is solely barely bigger than the velocity for the very best credit score rating score fluctuate for a model new vehicle mortgage. The month-to-month price is $342, and full curiosity of $1,431 is paid over the lifetime of the mortgage.

Nonetheless after we drop all the best way all the way down to the fourth credit score rating score fluctuate, 620 to 659, the speed of curiosity jumps to eight.773%, with a month-to-month price of $372, and full curiosity paid at $2,840 over the lifetime of the mortgage.

Uncover, nonetheless, that regardless that charges of curiosity are bigger on lower credit score rating scores on used automobiles – merely as they’re for model spanking new automobiles – the excellence isn’t as dramatic. Throughout the two examples above, the excellence in month-to-month price is solely $30, or $360 per yr. Over the four-year time interval of the mortgage, the complete distinction is $1,440.

That doesn’t come close to the $5,460 distinction on new automobiles. Nonetheless it nonetheless will improve the complete worth of proudly proudly owning the automotive.

Based totally on the examples for every new and used vehicle loans, it’s to your profit to do irrespective of you presumably can to reinforce your credit score rating score sooner than making use of for an auto mortgage.

What You Can Do to Improve Your Credit score rating Ranking for a Automotive Mortgage

Certainly one of many disadvantages of enhancing your credit score rating score for a vehicle mortgage is that you simply simply usually don’t have the type of time you could for many who had been making use of for a mortgage. If you’re going to purchase a home and even refinance your current one, you usually know months and even years prematurely. That provides you a great deal of time to do what’s wished to reinforce your credit score rating score sooner than making use of for financing.

The situation is often very completely totally different from vehicle loans. In plenty of circumstances, the selection to purchase a model new automotive is sudden, usually ensuing from an auto accident with excessive hurt to your vehicle, or a major restore that renders the automotive not worth fixing. You possibly can have solely days to amass financing, which might go away little time for superior preparation.

If that describes your situation, you’ll should work with the financing decisions immediately obtainable. We’ll provide strategies for a sudden vehicle mortgage situation inside the subsequent half.

Strategies to Improve Your Credit score rating Ranking

Within the occasion you’re not inside the vehicle market correct now, that’s the correct time to start out preparing your credit score rating score for a vehicle mortgage. Because of you have no speedy need for a vehicle or a mortgage, you’ll have the luxury of time to arrange.

Even for many who don’t plan to buy a vehicle for at least one different yr, that’s the time to start out monitoring your credit score rating score frequently. In case your credit score rating score doesn’t look like it’ll allow you to get advantageous financing, take steps now to reinforce the situation.

Help Improve Your Credit score rating Ranking

- Make ALL funds on time from this degree forward.

- Have any unfavorable errors eradicated out of your credit score rating report.

- Pay down or repay financial institution playing cards or loans to lower your credit score rating utilization ratio.

- Once you’ve received any overdue balances or collections, pay them off immediately.

The sooner you act on all or any the above, the bigger the advance in your credit score rating score will in all probability be. That’s on account of some credit score rating enchancment strategies need time to produce crucial options.

Within the occasion you get started now, sooner than you need financing, you’ll be ready when the time comes. And it’s most likely one factor close to a 50% chance that when it does, it’ll be sudden.

No matter if it does play out meaning – you’ll be prepared when it does.

Discover ways to Get a Mortgage Approval with a Unhealthy Credit score rating Ranking

What decisions do you might need while you’ve received an immediate need for financing for a vehicle, and don’t have time to reinforce your credit score rating score?

Fortuitously, there are a minimal of six strategies to pick from:

1. Get a preapproval out of your frequent monetary establishment

The monetary establishment the place you might need your checking and totally different accounts is extra more likely to take a further favorable view of your vehicle mortgage software program than a very new lender. Credit score rating unions could possibly be a superb greater selection since they usually make favorable fees obtainable on credit score rating scores as little as 650. However, in case your score is beneath 650, even credit score rating unions won’t be an selection.

However when you could get a preapproval out of your frequent monetary establishment or credit score rating union, it serves two essential capabilities:

- It lets you could have your financing in place earlier than you buy a vehicle, making you a stronger purchaser.

- It might really stress the vendor to get you a larger financing deal than the one offered by your monetary establishment or credit score rating union.

That’s the reason making use of at your monetary establishment or credit score rating union must be your first selection.

2. Retailer between lenders

Within the occasion you rely upon a single lender to get you top-of-the-line deal, significantly while you might need frequent, truthful, or poor credit score rating, you’ll be setting your self up for a foul deal. Buying is always a bonus, nonetheless considerably everytime you don’t have good or great credit score rating.

Even for many who get a preapproval out of your monetary establishment or credit score rating union, retailer at a lot of further lenders and always be open to financing preparations proposed by the auto vendor. You owe it to your self to get a larger financing deal if one is obtainable.

3. Buy a used vehicle

Throughout the two financing examples we carried out earlier, the speed of curiosity unfold based mostly totally on credit score rating score ranges is lower on used automobiles than it is on new automobiles. In case your credit score rating score is frequent or a lot much less, likelihood is you may get a larger deal looking for a used vehicle.

That’s partly on account of the mortgage portions on used automobiles are usually loads lower than what they’re new automobiles. In addition to, the depreciation of used automobiles is approach lower than it is in new automobiles. As a result of diminished risk coming from two directions, lenders are typically ready to produce further advantageous fees on used automobiles than on new ones.

4. Make an even bigger down price

Certainly one of many limitations that virtually always results in bigger charges of curiosity on vehicle loans could possibly be very low or nonexistent down funds. 100% financing is very widespread, significantly in case your current automotive doesn’t signify loads in the best way by which of trade-in price. Nonetheless it’ll set you up for the subsequent fee of curiosity.

It could be attainable to lower your fee of curiosity each by making a down price or by making an even bigger down price.

In its place of taking 100% financing, go along with 90%. If it’s attainable, put down 20%, with 80% financing. Not solely can that result in a lower fee of curiosity, nonetheless it could be the excellence between mortgage approval and denial in case your credit score rating is truthful or poor.

Making or rising the down price not solely reduces the mortgage amount, nevertheless it certainly moreover gives you “pores and pores and skin inside the sport.” That will make it a lot much less doable you’ll default on the mortgage and lose the automotive. Lenders are acutely aware of this, and are typically further receptive to approving loans with an even bigger down price.

5. Cut back the mortgage time interval

Throughout the lending enterprise, the longer the mortgage time interval, the bigger the prospect the mortgage carries. That’s why charges of curiosity on short-term loans are lower than these on longer ones. occasion is a distinction in charges of curiosity between 15-year mortgages and 30-year mortgages.

The equivalent applies to vehicle loans. Within the occasion you possibly can cut back the mortgage time interval from 60 months to 48 months, 42 months, and even 36 months, you’ll get a larger fee of curiosity.

6. Add a cosigner

If all the above strategies fail, the only option may be in order so as to add a licensed cosigner to the mortgage. The lender will make the mortgage based mostly totally on the credit score rating profile of your cosigner, which can provide you with entry to loads lower charges of curiosity even when your particular person credit score rating is truthful or poor.

So, What Credit score rating Ranking Do You Should Buy a Automotive?

What credit score rating score do you may wish to buy a vehicle? That’s a question biggest requested and addressed sooner than you may wish to get a mortgage to buy a vehicle.

As you presumably can see, your credit score rating score performs a major place inside the fee of curiosity you’ll get in your vehicle mortgage, which is an enormous part of the final worth of the automotive. One thing you’ll be able to do to reinforce your credit score rating score sooner than making use of for financing has the potential to save lots of plenty of you a whole bunch of {{dollars}}.

Nonetheless for many who desire a vehicle right away, and there’s no time to reinforce your credit score rating score, use one in every of many six strategies outlined above to get a larger deal.

A vehicle is among the many biggest payments inside the frequent household worth vary. You owe it to your self to do irrespective of is vital to lower that worth. Enhancing your credit score rating score for a vehicle mortgage, or making an end-run fiddle your credit score rating score, are top-of-the-line strategies to make that happen.

Related posts

Subscribe

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating