While you’ve bought simply these days pulled your credit score rating report and seen a price off, you might be questioning discover ways to take away the associated fee off out of your credit score rating report.

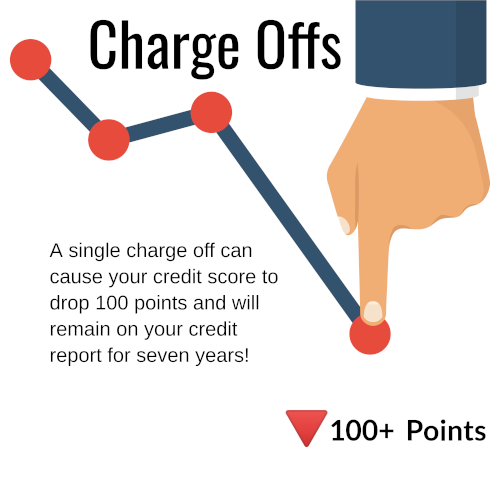

First, know {{that a}} price off in your credit score rating historic previous is a giant deal. It may well likely set off an unlimited credit score rating score drop.

It’s important to get price offs eradicated. In some other case, the associated fee off will maintain in your credit score rating report for seven years.

Let’s get into what selections you could possibly have accessible.

How Can I Take away a Value Off From My Credit score rating Report?

Listed beneath are 3 confirmed methods to remove a value off out of your credit score rating report:

- Negotiate A “Pay for Delete” & Pay The Creditor To Delete The Value Off

- Use The Superior Approach To Dispute The Value Off

- Have A Expert Take away The Value Off

1. Provide To Pay The Creditor To Delete The Value Off

One of many essential environment friendly strategies to get damaging devices eradicated out of your credit score rating report is to pay the debt in change for the creditor eradicating the associated fee off out of your credit score rating report.

With this system, you’d use your price as leverage to steer the debt collector to help restore your credit score rating. Nevertheless this works solely on an unpaid price off.

Do you have to’ve already paid the associated fee off nonetheless it’s nonetheless in your credit score rating report, you truly don’t have any leverage to barter its elimination.

Sooner than You Pay the Value Off

Sooner than you resolve to do that “pay for deletion” route, there are some belongings you need to keep in mind.

- If it’s an earlier price off, don’t provide to pay the entire amount due. Reasonably, it’s best to try to barter for decrease than what they’re asking. Start with 50 % and go from there.

- Some collectors will declare they will’t legally take away the associated fee off. This isn’t true. Proceed to barter until a deal will probably be made.

- You probably can negotiate over the phone, nevertheless always get the associated fee affiliation in writing sooner than sending them a take a look at or making an web price.

- Under no circumstances give a debt collector entry to your checking account.

Ask Sky Blue for Help

2. Use The Superior Approach to Dispute the Value Off

Do you have to don’t have the money to pay the soundness in full, or within the occasion you possibly can’t get the distinctive creditor to remove the associated fee off out of your credit score rating report, it’s time to dispute the damaging entry using a further superior approach.

To dispute the entry you’ll first need a duplicate of your current credit score rating report. As a result of coronavirus pandemic, you might get a free copy of your credit score rating report each week in its place of merely yearly.

Go to annualcreditreport.com to get a free credit score rating report from TransUnion, Experian, and Equifax.

When you could possibly have your credit score rating experiences in hand, uncover the associated fee off entry and take a look at every component to ensure each factor is completely appropriate.

The vital factor proper right here is to be very explicit. If one thing is inaccurate you could possibly have the becoming to dispute your complete entry.

Listed beneath are a few particulars that you simply must be verifying are appropriate:

- Account Amount

- Creditor Title

- Open Date

- Value off Date

- Value Historic previous

- Borrower Names

- Stability

Do you have to uncover any information that isn’t proper, write a letter to each of the three credit score rating bureaus stating you’ve found incorrect information that should be corrected or eradicated.

It’s best to guidelines the flawed information in your letter.

If the credit score rating reporting companies can’t affirm the entry, they’ll have to proper or take away the associated fee off in compliance with the Trustworthy Credit score rating Reporting Act. Usually the info merely can’t be verified and the entry could be eradicated.

If the associated fee off is reported exactly, nonetheless, disputing it will not help.

3. Have A Expert Take away The Value-Off

Do you have to’d pretty have an skilled work in your credit score rating, I like to recommend you strive Sky Blue Credit score rating Restore.

Credit score rating restore firms can usually get inaccurate and damaging devices eradicated fairly a bit sooner than you might by your self.

You’ll have to pay a month-to-month subscription charge and an preliminary set-up fee to get help from these credit score rating specialists.

Nevertheless you might get a free session to find out how a company will assist restore your credit score rating.

Even within the occasion you pay a lot of hundred {{dollars}} to a credit score rating restore agency like Sky Blue or Lexington Laws, it may possibly prevent way more by getting lower charges of curiosity and establishing a further safe personal finance life.

Credit score rating restore firms gained’t do one thing you couldn’t do your self. Nevertheless they will often work sooner and further successfully.

While you’ve bought delinquent funds, nonpayments, or charge-offs that are appropriate, credit score rating restore specialists gained’t have the power to help.

What Is A Value Off?

When you haven’t paid on an account for six months to a yr, a financial institution card issuer or totally different debt collectors will often mark your account as a “price off.”

This suggests the creditor has determined it’ll likely certainly not purchase your debt. It considers the debt a enterprise loss. The company can write off debt at tax time.

Nevertheless writing off the debt doesn’t indicate the creditor will stop its debt assortment efforts.

The reality is, the company might even lease a third-party debt collector to cope with the gathering course of. That’s important to know in case you’re contacted by a bunch firm you don’t acknowledge.

Each the gathering firm bought the debt out of your distinctive creditor and now needs to assemble on it — or the corporate has been employed by your financial institution card issuer, lender, or creditor to assemble the debt on behalf of the distinctive creditor.

It will happen with financial institution card debt, unpaid personal loans, and even hospital funds. One or two late funds shouldn’t result in a charge-off, nevertheless ongoing delinquency will lastly flip proper right into a charge-off.

How Does a Value Off Affect Your Credit score rating Score?

As quickly as an account has been charged off, two points will likely happen:

- First, you’re going to start receiving calls and letters from assortment companies attempting to assemble the debt.

- Second, the account could be marked as a “price off” in your credit score rating report.

A charged off account in your credit score rating report will devastate your FICO score. A single price off may trigger your credit score rating score to drop 100 elements or further. It’s an enormous deal.

Alongside along with your credit score rating score dropping, you’re moreover going to have a extraordinarily powerful time getting licensed for any new financial institution playing cards, mortgages, or auto loans.

Lenders rarely lengthen credit score rating to people with even one price off on their credit score rating report.

Paid vs. Unpaid Value Offs

There are two types of price offs which may appear in your credit score rating report.

While you’ve bought paid the charged-off account in full, the credit score rating bureaus will mark the account as paid; within the occasion you haven’t it will keep marked as unpaid.

Will My Credit score rating Score Improve if I Pay the Value Off in Full?

Some assortment companies may try to steer you paying off the entire amount of your price off will restore your FICO score. This is not true.

A paid price off will definitely look greater to lenders who take the time to do handbook underwriting, nevertheless it will have a minimal affect in your credit score rating score.

Moreover, paying off the associated fee off gained’t routinely delete the entry out of your credit score rating report. Paying it off will not take away the associated fee off account, each.

How Prolonged Do Value Offs Carry on Your Credit score rating Report?

A price off will keep in your credit score rating report for seven years, after which it’s routinely deleted.

For example, within the occasion you stopped making funds on thought-about one in every of your financial institution playing cards for six months, and it was marked as a value off on January 1, 2020, it’ll keep in your credit score rating report until January 1, 2027.

Even when the statute of limitations on the debt expires after three or 5 years in your state, your credit score rating report will nonetheless current the charge-off, and your credit score rating score will endure.

Statutes of limitations defend you from licensed movement nevertheless not from adversarial credit score or from phone calls from debt collectors.

Related posts

Subscribe

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating