Questioning in case your credit score rating score is as a lot as snuff?

If you’ve obtained a 620 credit score rating score, you aren’t alone. Tens of lots of of people are within the equivalent boat, and sometimes for the same causes.

Whereas a 620 credit score rating score may use some enchancment do you have to’re looking out for a assured approval with aggressive expenses, it does fall into the “truthful” differ.

Inside the article beneath, we’ll break down the weather that may be chargeable in your 620 credit score rating score, stroll by your lending selections, and share some surefire strategies for enhancing your score.

Desk of Contents

- Is 620 a Good Credit score rating Score?

- How To Improve a 620 Credit score rating Score

- Can You Get a Mortgage with a 620 Credit score rating Score?

Is 620 a Good Credit score rating Score?

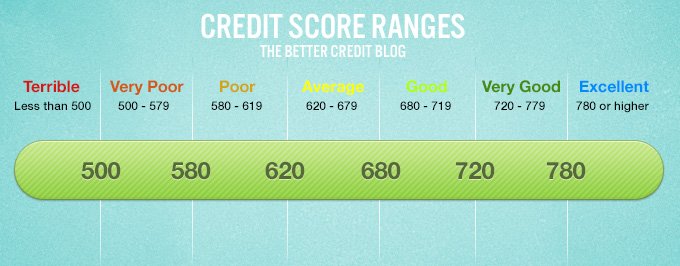

A FICO credit score rating score of 620 is taken into consideration to be “truthful,” whereas a score of 670 locations you throughout the “good” differ.

For reference, spherical 17% of individuals have a “truthful” FICO score, which ranges from 580 to 669.

Proper right here’s the outlook for a 620 credit score rating score:

- Credit score rating differ: Truthful

- Mortgage: Restricted selections

- Personal mortgage: Restricted selections

- Auto mortgage: Restricted selections

- Unsecured financial institution playing cards: Restricted selections

- Apartment rental: Potential approval

- Secured financial institution playing cards: Extreme approval

Plenty of credit score rating factors might find yourself in a score of 620. Individuals with “truthful” credit score rating scores usually have late funds on their credit score rating experiences, just a few of which may have gone to collections.

Others are on the path to repairing their credit score rating, as a result of it takes time to get higher from further excessive credit score rating occurrences like chapter, foreclosures, or judgments.

A couple of of those factors can preserve in your credit score rating report and drastically hurt your score for numerous years within the occasion that they aren’t eradicated.

A 620 is appropriate on the border of the credit score rating requirements for some loans, harking back to a conventional mortgage.

Though it is potential you may be permitted for installment loans or revolving strains of credit score rating with a 620, you gained’t get very aggressive expenses.

To earn most likely essentially the most aggressive expenses and purchase entry to further sources of funding, it’s important to work to assemble your score.

We’ll give you some pointers beneath.

Get Your FREE Credit score rating Report Within the current day

Straightforward strategies to Improve a 620 Credit score rating Score

With a 620, you’re in your technique to credit score rating score. Listed below are numerous concepts which will present you easy methods to take your credit score rating score to the following stage, with some virtually instantaneous outcomes and others paying off future:

- Get your value historic previous on monitor. 35% of your credit score rating score relies in your value historic previous, so it’s essential to prioritize making your whole future funds on time, automating funds when chances are you’ll. You additionally must make amends for missed funds as they hurt your score further the longer you permit them unsettled.

- Repay your cash owed. Credit score rating utilization accounts for an extra 30% of your credit score rating score, so it’s essential to give consideration to paying down your cash owed to see a severe enchancment to your score. If any of your accounts have gone to collections, contact them to get the collections account eradicated out of your credit score rating report because it might presumably affect your score for 7 years in another case.

- Don’t submit too many functions. A credit score rating score of 620 will limit your funding selections, and every software program you submit will potential finish in a tricky inquiry which will drop your score even further. Apply for model spanking new strains of credit score rating appropriately and evaluation the lender’s credit score rating requirements sooner than making use of. For individuals who’re making use of for a home or auto mortgage, try and submit all functions inside 14 days to limit the hurt achieved to your score.

- Get a secured financial institution card: Secured financial institution playing cards are designed to help people with restricted credit score rating histories and low scores to boost their credit score rating with accountable use. With a 620, chances are you’ll fully get permitted for a secured card. To yield the easiest outcomes, try and solely use 10% of your accessible stability, on no account using higher than 30%.

- Be a licensed client: If a appreciated one is ready to help out alongside together with your purpose of improve your credit score rating score, they may add you to one among their financial institution card accounts as a licensed client. Meaning, your value historic previous, credit score rating utilization, and credit score rating mix may see a quick enchancment when funds on the account are made on time.

- Report your lease: If part of your draw back is having a restricted credit score rating historic previous and likewise you’re in search of to indicate effectively timed funds, chances are you’ll pay to have your lease reported to the three credit score rating bureaus with RentReporters. Likewise, Experian Improve will report your utility funds.

- Hire a credit score rating restore agency: Sometimes, credit score rating restore is biggest left to the consultants. For individuals who’re having a tricky time getting entries eradicated out of your credit score rating report or actually really feel that you just simply’re in over your head, a credit score rating restore agency will assist get you on monitor and take the headache out of bettering your score.

Can You Get a Mortgage with a 620 Credit score rating Score?

You’re correct on the sting of being permitted for numerous sorts of loans with a 620 credit score rating score. For others, your approval odds are extreme.

In any case, you’ll potential face steeper APR, deposit requirements, and earnings requirements as a consequence of your “truthful” credit score rating score.

Proper right here’s a extra in-depth check out your eligibility for loans and financial institution playing cards.

Mortgage Decisions with a 620 Credit score rating Score

Your mortgage approval odds with a 620 really depend on what lender you apply with.

Take a look at the credit score rating requirements for each of the mortgage selections beneath:

| Mortgage Kind | Minimal Credit score rating Score |

|---|---|

| VA mortgage | No minimal set by VA; some lenders require a score of 580 or 620 |

| FHA mortgage | 500 with 10% downpayment, 580 with 3.5% downpayment |

| USDA mortgage | No minimal set by USDA; most lenders require a 640 |

| Standard dwelling mortgage | 620-640 |

VA loans are extraordinarily advantageous for members of the military and veterans, and chances are you’ll get permitted with some lenders with a 620.

You’ll moreover have no hassle getting permitted for an FHA mortgage, which is concentrated within the course of individuals with “low” or “truthful” credit score rating scores.

For individuals who’re looking out for the standard dwelling mortgage, based totally in your score, your earnings and downpayment will play a further important place throughout the approval course of.

Auto Mortgage Decisions with a 620 Credit score rating Score

Lenders deal with an unlimited menace after they drawback auto loans, so their expenses could also be pretty extreme.

That’s very true when you could have a “truthful” credit score rating score. With any score lower than a 700, getting permitted for an auto mortgage could also be powerful.

Quite a few lenders are ready to extend car loans to individuals with a 620 credit score rating score, nevertheless your charges of curiosity may amount to a few thousand {{dollars}} further curiosity than you’d with a “good” credit score rating score.

You additionally wants to note that your approval odds and expenses may be greater do you have to apply for a used car.

The good news is, it’s essential to have the power to get an auto mortgage alongside together with your current credit score rating score.

The upper info is you can merely get an rather more aggressive mortgage with somewhat bit work to boost your credit score rating.

Personal Mortgage Decisions with a 620 Credit score rating Score

Rather more good news, chances are you’ll be permitted for a personal mortgage with a 620 credit score rating score; nonetheless, it ought to embrace elevated expenses.

Likelihood is you may want to start your search with a credit score rating union. These financiers usually present a lower APR than banks and completely different native lenders.

On the same time, some on-line lenders are made with you in ideas, with further aggressive non-public loans tailored within the course of people with “truthful” and even “poor” credit score rating scores.

You could as effectively qualify for the loans beneath with a 620:

- Emergency mortgage

- Debt consolidation mortgage

- Installment mortgage

What Is the Biggest Credit score rating Card for a 620 Credit score rating Score?

With a very good credit score rating score, you might be eligible for every secured and unsecured financial institution playing cards.

Primarily, unsecured financial institution playing cards embrace a credit score rating limit based totally in your score and earnings.

Secured enjoying playing cards, then once more, usually limit your credit score rating limit to the amount of money you deposit, with the potential to develop over time based totally in your value historic previous. They’ve very low credit score rating score requirements.

The higher your score is, the additional cash may be accessible to you each month. Your score may moreover determine your eligibility for low expenses, restricted expenses, and rewards.

As quickly as as soon as extra, it’s essential to look at each card’s score requirements sooner than making use of and solely apply for the simplest financial institution playing cards for truthful credit score rating.

In case you’re denied approval for an unsecured card, or it comes with extreme expenses and curiosity, a secured card can nonetheless present you easy methods to, bettering your credit score rating choice, value historic previous, and credit score rating use.

Don’t neglect to limit your functions as submitting numerous can do further harm than good.

Improve Your 620 Credit score rating Score Within the current day

Whether or not or not you’re in your technique to rebuilding your credit score rating after liens or chapter launched it down, in any other case you’re a faculty grad with nothing nevertheless scholar mortgage repayments in your credit score rating report, a 620 is an excellent stepping stone.

With some strategic steps, chances are you’ll improve your score by dozens of things quickly and work your means as a lot as a “good” credit score rating score.

For individuals who haven’t already, be a part of a credit score rating monitoring service like Credit score rating Karma so chances are you’ll monitor your score, understand modifications to your report, and uncover specialised provides and concepts for enhancing your score.

From there, start paying down cash owed and catching up in your missed funds, using credit score rating strains appropriately to boost your score.

For individuals who need rather more assist, don’t hesitate to contact an expert, taking advantage of credit score rating restore firms to get your score the place it have to be.

Related posts

Subscribe

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating