A wonderful credit score rating score is essential within the occasion you’re attempting to get licensed for one thing from a rewards financial institution card to a mortgage.

Nevertheless what score do lenders take into consideration to be good?

You most likely have a 560 credit score rating score, your approval odds for loans are low, and your credit score standing is pretty poor.

Fortunately, you presumably can restore a FICO score on this fluctuate, accessing further funding with greater expenses.

Desk of Contents:

- Is 560 a Good Credit score rating Score?

- How To Improve a 560 Credit score rating Score

- Can You Get a Mortgage Approval with a 560 Credit score rating Score?

Is 560 a Good Credit score rating Score?

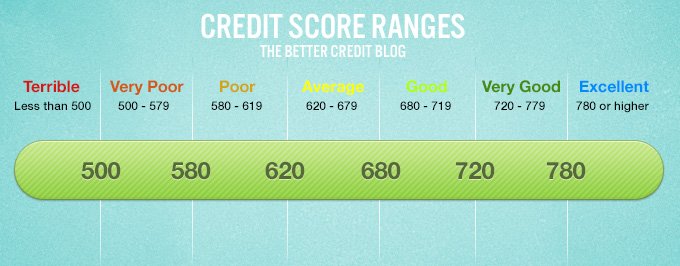

560 credit score rating score is taken into consideration to be “very poor,” falling below the standard shopper’s FICO score.

For reference, a score of 670 is taken into consideration to be “good,” which suggests you’re merely over 100 elements shy of getting a wonderful score.

There are a selection of parts affecting your credit score rating score, with some carrying further weight than others.

A number of of the most typical contributors to a “very poor” score embody:

- Late funds

- Liens

- Judgments

- Chapter

- Repossessions

- Debt collections

- Foreclosures

The issues above can hinder your entry to every revolving traces of credit score rating and installment loans.

With a 560 credit score rating score, you’ll have very restricted mortgage selections and should have a troublesome time getting licensed for unsecured financial institution playing cards.

In case your score is 560 or below, you have to work in course of repairing your credit score rating. We’ll provide you with some pointers below.

How one can Improve a 560 Credit score rating Score

Do you have to’re tired of your credit score rating score bringing you down, listed under are some concepts to help improve your credit score rating score.

Whereas some sides of repairing your credit score rating take time, others might have quick outcomes.

- Focus in your value historic previous: Your value historic previous constitutes 35% of your credit score rating score, so making funds on time is important to sustaining your score. Automating funds is sweet. The longer you enable your cash owed unpaid, the additional damage they do to your score. Steer clear of letting loans flip into delinquent or defaulting the least bit costs.

- Pay down cash owed: Credit score rating utilization is the next best have an effect on in your credit score rating, making up 30% of your common score. Paying off cash owed can yield quick and spectacular outcomes, demonstrating that your borrowing and funds are under administration. You most likely have any collections accounts in your report, negotiate a pay-for-delete settlement.

- Limit credit score rating capabilities: With a 560 credit score rating score, your possibilities of getting licensed for lots of types of loans and financial institution playing cards are slim, and making use of for model new traces of credit score rating drops your score. Do your evaluation, limit your new capabilities, and solely apply within the occasion you actually really feel assured that you simply simply’ll be licensed.

- Use a secured financial institution card: Secured enjoying playing cards are made for people with subpar credit score rating scores or transient credit score rating histories, so that you simply would possibly be capable to get licensed with a 560 credit score rating score. When used responsibly, these enjoying playing cards can help you to assemble your score quickly. To maximise outcomes, try and solely profit from 10% of the obtainable amount of credit score rating each month.

- Flip into a licensed client: Ask a cherished one with a secure credit score rating score in order so as to add you as a licensed client on actually one among their financial institution playing cards so your score can revenue from their nicely timed funds.

- Use a credit score rating restore agency: If repairing your credit score rating appears like an superior exercise, chances are high you will must pay for a credit score rating restore service like Credit score rating Saint. They’ll contact debt collectors, dispute claims, and further, boosting your score quickly.

Ask Credit score rating Saint for Help

Can You Get a Mortgage with a 560 Credit score rating Score?

The lower your credit score rating score is, the more durable it is to get licensed for loans.

Some types of loans are further accessible than others on this credit score rating fluctuate, nonetheless usually, loans for candidates with poor credit score rating embrace terribly high-interest expenses.

Try your selections below for loans with a 560 credit score rating score.

Mortgage Selections with a 560 Credit score rating Score

Getting a home mortgage with a 560 score is simpler said than completed, nonetheless you do have only a few selections.

Listed under are the credit score rating requirements for each form of mortgage to give you an idea of whether or not or not you presumably can qualify or not.

| Mortgage Form | Minimal Credit score rating Score |

|---|---|

| VA mortgage | No minimal from VA; lenders might require a 580 or 620 |

| FHA mortgage | 500 with 10% down, 580 with 3.5% down |

| USDA mortgage | No minimal from USDA; lenders will potential require a 640 |

| Typical residence mortgage | 620-640? |

Do you have to’re an lively duty member of the navy or a veteran, a VA mortgage is your best guess. In every other case, your solely alternative might be going an FHA mortgage.

These loans are excellent for low to common earners, allowing for every a low down value and a low credit score rating score.

Auto Mortgage Selections with a 560 Credit score rating Score

Vehicles are riskier to finance for lenders. To compensate for that risk, lenders value high-interest expenses.

In case your credit score rating score is lower than a 700, you’ll have a more durable time qualifying for a automotive mortgage.

Though you would possibly be capable to qualify with a score of 560, it’ll embrace terribly high-interest expenses.

You’ll be able to too depend on further scrutiny as lenders assess your utility, notably by way of your value historic previous.

Whereas the standard credit score rating score for every new and used cars will not be lower than 100 elements elevated than a 560, you have to have the flexibility to get licensed for a mortgage, counting on the car and your income.

You will need to additionally remember that you simply simply’re further extra more likely to get licensed for a used automotive mortgage than a model new automotive mortgage with a 560.

Non-public Mortgage Selections with a 560 Credit score rating Score

It’s possible you’ll qualify for a personal mortgage with a 560 credit score rating score, though you presumably can depend on elevated expenses proper right here, too.

In some circumstances, working with a neighborhood credit score rating union can help you to get licensed with barely greater expenses than a monetary establishment as federal credit score rating unions have a lower most APR.

If making use of with a credit score rating union fails, you’ve got obtained entry to various on-line lenders who actually concentrate on offering non-public loans to people with below-average credit score.

Together with a personal mortgage, with a 560 you would possibly be capable to protected an emergency mortgage, debt consolidation mortgage, or an installment mortgage.

What Is the Best Credit score rating Card for a 560 Credit score rating Score?

Most people with truthful or good credit score rating go for unsecured financial institution playing cards. With the kind of card, your credit score rating limit is a set amount based totally in your credit score rating report and income.

The upper your score is, the higher the spending limit you presumably can depend on. On account of your credit score rating score largely determines your creditability, these enjoying playing cards could also be troublesome to get licensed for with poor credit score rating.

However, there are some unsecured enjoying playing cards with low credit score rating limits which will be designed for individuals with low credit score rating scores.

One other chances are high you will want to consider with a 560 credit score rating score is a secured financial institution card. With these enjoying playing cards, you place down a security deposit that acts as your credit score rating limit.

Secured enjoying playing cards are excellent for setting up your credit score rating score and may help collectively along with your credit score rating mix, value historic previous, and credit score rating utilization.

Whichever form of card you apply for, focus on the APR and prices as some are elevated than others.

As quickly as as soon as extra, we advise that you simply simply limit your capabilities as most would require a troublesome credit score rating take a look at which will lower your score further. It’s best to have the flexibility to easily evaluation your approval odds for a lot of enjoying playing cards sooner than making use of.

Improve Your 560 Credit score rating Score As we communicate

Whereas a 560 does fall into the poor fluctuate of credit score rating scores, your score might presumably be worse.

Do you have to’re feeling defeated after making use of and being denied for loans or financial institution playing cards attributable to your score, there’s no time like the present to start out out working to revive your credit score rating score.

You would be shocked at how quickly you presumably can take your score from poor to truthful, supplying you with entry to greater lending selections and putting you on the path to having a wonderful score.

Try the weather influencing your credit score rating score, provide you with a plan to boost it, and stick with it.

And don’t overlook that you’ve got entry to tons of good on-line sources and credit score rating restore professionals within the occasion you need assist alongside one of the simplest ways.

Related posts

Subscribe

* You will receive the latest news and updates on your favorite celebrities!

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating