Overlook maxing out your financial institution playing cards, listed beneath are some easy strategies anyone can use to max out your credit score rating score.

Most of these strategies may be utilized by people who have every good and low credit score.

I prefer to suggest that you just try and do as many as potential on an ongoing basis.

5 Amazingly Simple Credit score rating Optimization Strategies

Listed below are 5 simple strategies that it’s good to use to optimize your credit score rating score:

- Prohibit Laborious Inquiries

- Preserve a Mixture of Credit score rating Accounts

- Optimize Your Credit score rating Utilization Ratio

- Open a Important Credit score rating Card

- Assemble Your Credit score rating Historic previous

1. Prohibit Laborious Inquires to No Further Than 2 All through a 2 12 months Interval

There are two types of credit score rating inquiries which can current up in your credit score rating report. One can negatively impact your credit score rating score, and one doesn’t.

- Mild Inquiry: This type of inquiry is just not going to negatively impact your credit score rating score so that you simply shouldn’t worry about these. Examples of sentimental inquiries are everytime you confirm your credit score rating report, an employer pulls your credit score rating report, or everytime you use a credit score rating monitoring service.

- Laborious Inquiry: This type of inquiry can have an effect on your credit score rating score (nonetheless not on a regular basis). Examples of laborious inquiries are everytime you apply for a financial institution card, a automotive mortgage, and so forth.

The first issue to keep in mind by way of credit score rating inquiries is {{that a}} laborious inquiry means you is perhaps making use of for credit score rating, whereas a mushy inquiry is simply you (or one other individual) looking at your credit score rating report for causes aside from loaning you money.

So, what variety of inquiries is just too many? As a typical rule, it’s good to maintain laborious inquiries beneath 2 all through any given two 12 months interval. Laborious inquiries fall off your credit score rating report after two years.

This primarily tells lenders that you just aren’t actively looking out for a bunch of credit score rating. Likelihood is you will start to see your credit score rating score negatively affected if you hit three or further laborious inquiries.

Having larger than two laborious inquiries obtained’t kill your credit score rating score, nonetheless it’s going to most likely take just some elements off.

2. Preserve a Mixture of Credit score rating Account Types

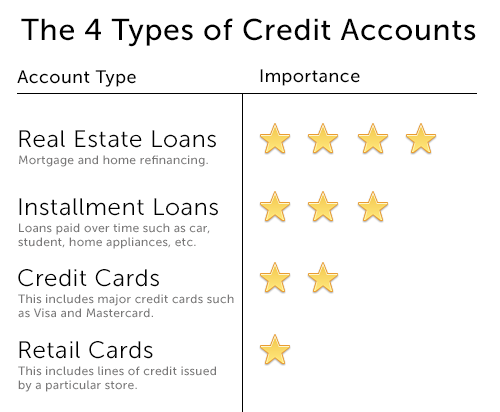

There are 4 kinds of credit score rating accounts in your credit score rating report and the form of account determines how plenty of an have an effect on it has in your credit score rating score.

I put collectively the graphic beneath to point you which ones kinds matter most likely essentially the most:

It’s best to keep up a mixture of all these account kinds. It doesn’t suggest that it’s good to shut your retail enjoying playing cards, it merely signifies that an precise property mortgage will larger than most likely have a a lot greater have an effect on in your credit score rating score than a retail card or financial institution card.

3. Use Credit score rating Utilization Ratios to Your Profit

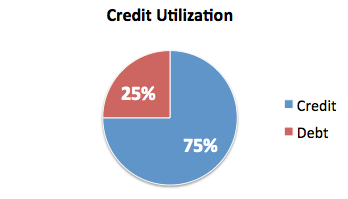

Maxing out your financial institution playing cards will kill your credit score rating score truly fast. Credit score rating vs. Debt ratios are one factor of us usually overlook.

Most people assume that their credit score rating score isn’t impacted besides they’re late on a price.

This isn’t true! The reality is, I’d counsel sustaining each financial institution card beneath 25% utilization. In several phrases, don’t value up larger than 25% of your obtainable credit score rating on any express card.

Once you’ve bought already charged larger than 25%, paying all of it the way in which right down to beneath 25% can significantly enhance your score. I’ve written an entire article about credit score rating utilization that it’s good to attempt for those who want to understand it further in depth.

4. Open at Least One Important Credit score rating Card

This one can typically be troublesome for people who’ve low credit score, nonetheless it must be one factor you are employed in course of in the long run.

Since principal financial institution card companies typically require first price credit score rating to approve you for one amongst their financial institution playing cards, having one (or just some) reveals that they perception you.

It is going to positively impact your credit score rating score. As soon as extra, if you’ve bought low credit score, merely maintain this in ideas and work in course of attending to the aim the place you’re going to get accredited for a Visa or Mastercard.

I need to additionally level out that ought to you don’t have any credit score rating, typically principal financial institution card companies will approve you. Ponder this your trial interval and don’t screw it up 🙂

5. Develop Your Credit score rating Historic previous by Defending Earlier Accounts Open

A mistake that I see of us do repeatedly (and one I did myself, actually) is shut outdated accounts contemplating that it will improve their credit score rating score.

A person typically does this because of the outdated account has a late price or one factor. The truth is, this isn’t going to make the late price “go away” –it’s going to nonetheless be there.

What you will do by closing an outdated account is to stop developing historic previous for that account.

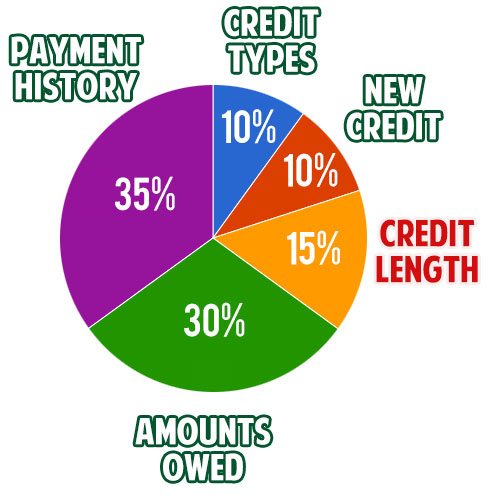

There are a selection of components used to calculate your credit score rating score (see chart beneath), and your credit score rating measurement makes up a very good portion: 15%.

By sustaining outdated accounts open, the account continues to assemble credit score rating historic previous and this is usually a good issue! In the long run, your credit score rating score will typically revenue.

Optimize Your Credit score rating Report

Lastly, you could additionally on a regular basis spend some time cleaning up your credit score rating report by eradicating any collections or late funds. I prefer to suggest getting unfavorable entries eradicated barely than wait 7 years for them to routinely fall off.

This way you don’t have to stress about them affecting your potential to get a mortgage.

I counsel you attempt Lexington Regulation Credit score rating Restore. They’ll take away the unfavorable objects. Give them a reputation at 1-844-764-9809 or Check out their website.

Related posts

Subscribe

* You will receive the latest news and updates on your favorite celebrities!

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating