Late funds is normally an enormous deal.

rely significantly in direction of your FICO ranking calculation which so many lenders take a look at for those who apply for a mortgage.

Nonetheless, in my experience, it’s truly not that troublesome to get late funds eradicated and see a bump in your credit score rating ranking.

How Prolonged Do Late Funds Maintain On Your Credit score rating Report?

Late funds can preserve in your credit score rating report for seven years. This could impact your means to get loans.

A lower credit score rating ranking may even impact the charges of curiosity you get within the occasion you do get licensed for a financial institution card or auto mortgage.

So I prefer to advocate you take steps to get missed funds off your credit score rating report sooner than making use of for model spanking new credit score rating as soon as extra.

First, I strongly counsel monitoring your credit score rating report again to see correct when devices are eradicated and so that you presumably can keep observe of your progress.

Experian gives free entry to your credit score rating report on a month-to-month basis with free credit score rating report monitoring too.

And you’ll get a free credit score rating report from each of the three credit score rating bureaus every week — in its place of yearly — by means of April of 2021 because of the Covid-19 pandemic.

Go to annualcreditreport.com to entry your Equifax, Experian, and TransUnion credit score rating research. I’ll counsel only a few additional strategies to watch your credit score rating ranking completely free below.

Can I Take away Late Funds From My Credit score rating Report?

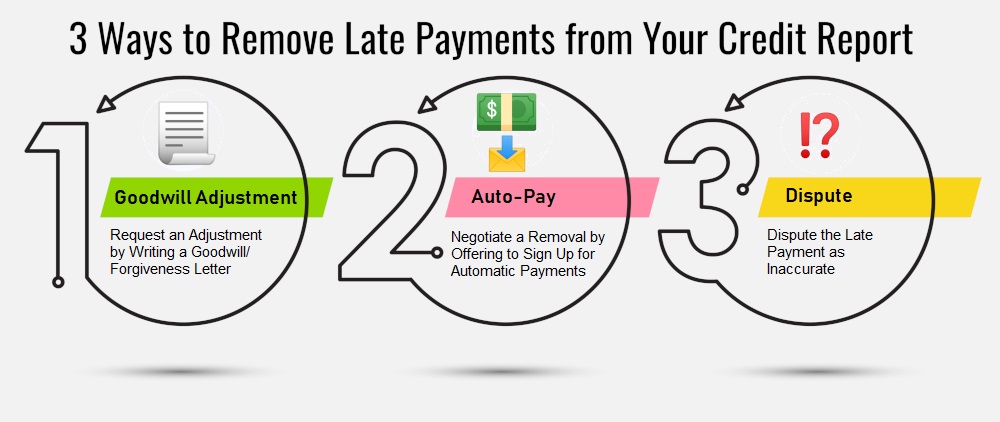

Listed below are 3 confirmed strategies to remove late funds from a credit score rating report:

- Request a “Goodwill Adjustment” from the Creditor

- Negotiate to Take away a Late Charge by Signing Up for Auto-Pay

- Dispute the Late Charge Entry on Your Credit score rating Report as Inaccurate

1. Request a “Goodwill Adjustment” from the Distinctive Creditor

The idea is simple, and it actually works surprisingly correctly.

Many events collectors are happy to grant “goodwill adjustments” in case your earlier price historic previous is relatively good and you have got established relationship with the creditor.

That’s perhaps the best and surest choice to get a late price eradicated out of your credit score rating report.

The tactic entails writing the creditor a letter explaining your state of affairs (why you may have been late) and asking that they “forgive” the late price and modify your credit score rating report accordingly.

The best possibility to put in writing a goodwill/forgiveness letter is to utilize the sample letter I created as a template. This system will not work whenever you’ve received various late funds.

Get a Free Copy of Your Credit score rating Report

2. Negotiate Eradicating by Offering to Sign Up for Automated Funds

I’ve in no way really tried this technique myself, nonetheless from what I understand collectors commonly provide to remove late price entries within the occasion you, in commerce, agree to affix automated funds.

This system works correctly for every occasions: the creditor can assure future on-time funds may be made, and likewise you don’t have to worry about remembering to make funds or being charged late fees within the occasion you forgot to pay by the due date.

I would like to take heed to from these of you who’ve succeeded with this technique!

Exchange: A lot of readers have verified that this technique did work for them, so do that subsequent if a goodwill letter doesn’t work.

In truth, automated funds are solely good whenever you’ve received the money in your checking account to cowl the transaction.

Seeming like an extreme quantity of with the intention to take care of by your self to this point? That’s okay! I prefer to advocate asking Sky Blue for the allow you to need in your credit score rating restore journey.

Ask Sky Blue for Help

3. Dispute the Late Charge as Inaccurate

I undoubtedly do not advocate lying or claiming antagonistic data is inaccurate whenever you acknowledge that you just simply truly did make late funds.

BUT, within the occasion you uncover ANY inaccuracies on the late price entry (dates, portions, and so forth), you presumably can dispute the late price as inaccurately reported.

Usually collectors have a difficult time verifying the exact particulars of your account historic previous.

As a result of this truth, within the occasion you write a dispute letter protesting the inaccurate late price and the creditor can’t (or simply doesn’t trouble) to substantiate it, the antagonistic entry may be eradicated in accordance with the Trustworthy Credit score rating Reporting Act (FCRA).

Appropriate data out of your creditor should embrace:

- Your determine

- Creditor’s determine

- Charge data

- Account amount

That’s moreover an superior method on learn to take away assortment accounts from a credit score rating report.

Bonus Approach: Have A Expert Take away The Late Funds

We understand that credit score rating restore may be overwhelming. For individuals who’d comparatively have educated credit score rating restore agency help, I counsel you check out Sky Blue Credit score rating Restore.

Credit score rating restore specialists like these at Sky Blue and Lexington Laws can take away inaccurate antagonistic data fairly loads earlier than you presumably can working by your self.

Credit score rating restore firms do value month-to-month subscription fees while you’re employed with them.

Nevertheless within the occasion you intend to make use of for model spanking new credit score rating inside the following six months to a 12 months, fixing your poor credit score will repay inside the kind of lower charges of curiosity.

Merely to be clear: Credit score rating restore firms acquired’t do one thing you presumably can’t do your self. They’ll merely work sooner and further successfully.

How Loads Does a Late Charge Harm My Credit score rating?

A single late price can have a good larger impression in your credit score rating file than you could possibly suppose.

Once you’ve received good or near-perfect credit score rating, a late price might knock upwards of 100 elements off your FICO ranking.

That’s on account of price historic previous incorporates 35 % — crucial chunk — of your credit score rating ranking.

When you already have wonderful credit score rating, you’ve got received additional room for one antagonistic merchandise to take an enormous hit.

A single late price can have a smaller impression in case your credit score rating file already has some points equivalent to various late funds or a charge-off or assortment account.

How one can Maintain Late Funds Off Your Credit score rating File

For individuals who’re finding out this and already have delinquencies reported in your credit score rating report, it’s clearly too late to forestall the antagonistic marks from displaying in your credit score rating historic previous.

You should stick with the methods I outlined above to remove the late funds and restore your credit score rating.

Nevertheless within the occasion you aren’t however 30 days late on a price, study this half rigorously. You presumably can nonetheless cease a late price from hurting your credit score rating ranking.

Doing this is usually a lot easier than trying to remove the antagonistic devices later.

Proper right here’s what you’ll be able to do:

Speak with the Credit score rating Issuer

It’s tempting to ignore late funds, notably from financial institution card firms that will’t flip off your utilities or repossess your automotive. Nevertheless try and avoid this temptation.

A lot of credit score rating accounts provide price flexibility it’s worthwhile to reap the advantages of within the occasion you’re struggling to make on-time funds.

Some firms will assist you to skip a price so you’ll get your personal funds once more on observe.

Nevertheless you acquired’t discover out about these potentialities within the occasion you don’t get in touch alongside together with your creditor.

So don’t ignore their phone calls or emails, notably for those who’re nonetheless not 30 days late.

Use Covid-19 Discount Packages If Potential

All through the coronavirus pandemic a great deal of collectors, equivalent to scholar mortgage servicers, froze credit score rating accounts.

Totally different collectors started Covid-19 discount packages for account holders who had been affected by the pandemic.

Nonetheless, others stopped sending late price data to the credit score rating bureaus or selling charge-off accounts to assortment corporations.

This kind of help can help keep your accounts in good standing and allow you to take care of good credit score rating all through troublesome events.

Nevertheless you could possibly must ask your creditor to enroll you in these packages. As soon as extra, talking alongside together with your creditor sooner than your account turns into 30 days or additional delinquent may be key.

Change Due Dates or Consolidate If Helpful

Most financial institution card issuers equivalent to Capital One and Uncover will assist you to change your due date to avoid price conflicts with completely different funds equivalent to your rent or auto mortgage price.

Usually a simple change like this might create the discount you need to keep your credit score rating ranking on the up and up.

You may moreover take into consideration consolidating various smaller financial institution card balances into one larger financial institution card or personal mortgage.

You’d have fewer due dates to remember, and also you may perhaps pay a lot much less in curiosity charges, too.

Realizing Your Rights Can Help You Negotiate

Congress has handed various authorized pointers to help consumers negotiate with credit score rating reporting corporations and collectors.

The Trustworthy Credit score rating Reporting Act, for example, gives you entry to your credit score rating file completely free yearly.

Go to annualcreditreport.com to get your free credit score rating research from the three credit score rating reporting bureaus.

For individuals who uncover inaccurate data, the regulation requires the bureaus to restore this data or take away it.

Be sure to file a criticism with the Consumer Financial Security Bureau in case your makes an try to remove inaccurate antagonistic data get no response.

Monitoring Your Credit score rating Can Help Forestall Points

Certain, you’ll get your free credit score rating report, nonetheless some financial institution card firms and mortgage servicers provide free credit score rating monitoring that’s constructed into your regularly life.

You presumably can merely log into your account on-line or faucet on an app to see your FICO or VantageScore anytime.

You could as nicely monitor your credit score rating using free apps like Credit score rating Sesame and Credit score rating Karma. These apps acquired’t current your official FICO ranking nonetheless they may warn you to large modifications.

An enormous and sudden change to your credit score rating ranking might very nicely be a sign of id theft or of inaccurate late funds being reported by definitely certainly one of your collectors.

Detecting this sort of downside early will make fixing it easier.

Related posts

Subscribe

* You will receive the latest news and updates on your favorite celebrities!

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating