We normally affiliate credit score rating restore with people who’ve very poor credit. Nearer to the fact, nonetheless, is that virtually all people desires to engage in credit score rating restore at some time of their lives, and often better than as quickly as.

Sure, it’s usually most essential for these with low credit score rating scores. Nonetheless even you most likely have a median or good ranking, you may want to enhance it far more, each to boost your chances of being accredited for positive mortgage, or getting lower costs and better phrases.

There may be some ingredient of self-esteem in desperate to have probably the greatest credit score rating ranking doable.

Nonetheless in financial phrases, your credit score rating ranking really does affect your bottom line. As an example, a credit score rating ranking of 750 may get you the underside cost on a home mortgage, whereas a ranking of 600 may result in a decline.

It does not matter what your current credit score rating situation is, sometimes it’s advisable to do further than merely make your funds on time. You may should work on getting some damaging data eradicated, or rearranging your cash owed to get your credit score rating ranking better.

Each represents a sort of credit score rating restore, and that’s exactly what we’re going to debate on this text.

Desk of Contents:

- What’s Credit score rating Restore

- Credit score rating Restore Companies

- Credit score rating Restore Software program program

- DIY Credit score rating Restore

- Credit score rating Restore Takes Time

- Credit score rating Restore Infographic

What’s Credit score rating Restore?

Credit score rating restore begins out with two basic targets:

- Do away with or scale back damaging entries and data in your credit score rating report, and

- Improve constructive entries.

Eliminating or Minimizing Opposed Credit score rating Entries

The tactic begins with getting a replica of your most modern credit score rating report, and analyzing each line merchandise. If any are displaying damaging data, these are these you should zero in on.

In attempting on the negatives, the first function is to scan for any that may very well be in error. These can embrace collections that are not yours, accounts with damaging charge histories that belong to a different particular person akin to an ex-spouse, or open balances you’ve prolonged since paid.

By getting this data corrected, or eradicated out of your report, your credit score rating ranking will get an immediate improve.

Considered one of many largest potential negatives, and one which’s imprecise to most prospects, is excessive credit score rating utilization. That’s determined by what’s usually known as your credit score rating utilization ratio. That’s the amount you owe in your credit score rating traces, divided by your complete credit score rating limits.

As an example, let’s say you can have 5 financial institution playing cards with a blended credit score rating prohibit of $20,000. In case you owe an entire of $15,000 all through the 5 taking part in playing cards, your credit score rating utilization ratio is 75% ($15,000 divided by $20,000).

A credit score rating utilization ratio of 75% is taken under consideration excessive, and may crush your credit score rating ranking. Credit score rating utilization is the second largest credit score rating ranking determining problem, behind solely charge historic previous. It accounts for 30% of your ranking, so retaining this amount at an inexpensive diploma is mission-critical.

A credit score rating utilization ratio of 80% or further is taken under consideration indicative of potential default, since you’re approaching maxing-out your financial institution playing cards. The lower the pace is, the upper. Nonetheless a ratio below 30% is taken under consideration excellent. If in case you may have a fantastic credit score rating ranking, and in addition you’re searching for to boost it, getting the ratio below 30% may be a really highly effective method.

Rising Optimistic Credit score rating Entries

Rising constructive credit score rating entries may very well be equally very important. Oftentimes, a credit score rating ranking is weighed down by an absence of advantageous credit score rating. It may probably even be held down by an absence of sufficient credit score rating.

If you already have good credit score rating, you’ll naturally must proceed making your funds on time.

Nonetheless most likely the best strategies to increase your ranking is by paying off a mortgage or a financial institution card. We’ve already talked about the importance of credit score rating utilization, and that undoubtedly should be thought-about for those who want to improve your ranking.

Nonetheless paying off a financial institution card totally, or an installment mortgage, is a method to extend your ranking numerous elements immediately.

The credit score rating bureaus like paid loans, on account of they confirm effectively achieved credit score rating obligations. The additional of them you can have, the upper. This isn’t to say that it’s advisable to repay your entire loans. Nonetheless your credit score rating report should mirror a healthful combination of every open and paid loans.

If in case you may have poor credit score rating, you undoubtedly should work on eradicating as many damaging objects as doable. Nonetheless it’s equally very important in order so as to add good credit score rating to the combo.

You’ll be able to try this by taking small loans, making the funds on time, and paying them off early.

What to Do if You Can’t Get Licensed for New Credit score rating

In case you’re unable to get accredited for typical loans or financial institution playing cards, look into secured financial institution playing cards or credit score rating builder loans.

Secured financial institution playing cards usually require that you just simply put up an sum of cash equal to the credit score rating line as collateral. Because of the street is completely secured, the monetary establishment could be very liable to approve the credit score rating line.

You can then use the financial institution card, and your charge historic previous will seemingly be reported to all three credit score rating bureaus. This gives you with a constructive credit score rating historic previous that may improve your ranking.

Credit score rating builder loans can accomplish the equivalent function, moreover you can open one with none money the least bit. Many banks and credit score rating unions provide credit score rating builder loans.

You apply for a mortgage, and when the monetary establishment approves it, the funds are immediately deposited proper right into a monetary financial savings account to behave as collateral for the mortgage.

Your month-to-month funds on the mortgage are paid out of the monetary financial savings account. As a result of it happens by automated draft, the funds are assured to be on time.

It ought to happen totally out of sight for you, and may most likely value you decrease than $100 for the curiosity on the mortgage. Within the meantime, the monetary establishment will report your good charge historic previous to the credit score rating bureaus, along with the paid mortgage standing when the time interval ends.

Each method will permit you in order so as to add good credit score rating which will work wonders to increase your credit score rating ranking.

Credit score rating Restore Companies

Whether or not or not or not you have to engage the suppliers of a credit score rating restore agency really depends on the state of your credit score rating.

In case your credit score rating ranking is being weighed down by one or two objects, it would seemingly be less expensive to deal with these your self.

And also you most likely have a median or good credit score rating ranking, and in addition you’re merely searching for to boost it, you have to merely adjust to the steps laid out under “Learn to Restore Your Credit score rating”.

Nonetheless you most likely have truthful or poor credit score rating, introduced on by numerous damaging credit score rating entries, using a credit score rating restore agency should be a consideration. Each certainly one of many damaging entries may ought to be challenged, and which may be every troublesome and time-consuming.

In case you’ve in no way effectively disputed a credit score rating merchandise sooner than, in any other case you don’t actually really feel cosy negotiating, using a credit score rating restore agency may be your most interesting method.

An excellent credit score rating restore agency is staffed by expert, competent professionals, who know their methodology throughout the credit score rating universe. They’re correctly acquainted with disputing damaging data and negotiating with collectors – even the uncooperative ones.

In addition to, it’s normally greater to have a third-party signify you in a most likely confrontational situation than to do it your self.

You’ll pay a cost for his or her suppliers, nevertheless it may very well be correctly worth paying in case your credit score rating report reveals an entire lot of damaging entries.

If in case you may have numerous considerably troublesome credit score rating circumstances in your report, you have to lean in direction of a credit score rating restore agency that’s moreover a laws company (which many are). Usually, merely getting an authorized skilled involved in your situation is adequate to make it ornery creditor cooperate.

Discovering the Correct Credit score rating Restore Agency

You’ll ought to be cautious in selecting credit score rating restore agency. The enterprise has grown large in current instances, and it’s full of companies which have little or no precise experience.

They’ll end up costing you money, with out delivering any satisfactory outcomes.

Proper right here at Larger Credit score rating Weblog now we’ve got a listing of ten credit score rating restore companies you may have the option to try to begin the search for one that may provide the outcomes you need.

Credit score rating Restore Software program program

Credit score rating restore software program program is an area of credit score rating restore that we normally discourage readers from using.

It’s one different part of the credit score rating restore enterprise that’s been rising steadily in current instances, nevertheless is of questionable price at most interesting.

You’ll be charged a cost, which will range anyplace from $50 to as loads is $400. In commerce, you’ll be given software program program to hint your damaging credit score rating data, along with sample credit score rating dispute letters.

There are three points with credit score rating restore software program program you need to think about:

- As talked about above, you’ll pay a cost for the product.

- They solely current varieties, which means you’ll be doing the entire work.

- Usually, there’s nothing they provide which you can’t get elsewhere on the web with out spending a dime.

Positive, an entire lot of providers are literally on the market on the web. Nonetheless that doesn’t indicate they’re all worth paying for. Credit score rating restore software program program falls into this class. Merely having varieties gained’t restore your credit score rating points, nor will it stop the time wished to get the job carried out.

Do-It-Your self (DIY) Credit score rating Restore

DIY credit score rating restore is always an selection, as long as you are feeling as a lot because the obligation. It is best to have on the very least some experience effectively disputing credit score rating data so far, along with be cosy coping with most likely tense negotiations. In case you do, it’s undoubtedly worth attempting.

We’re not going to go an extreme quantity of factor proper right here, on account of DIY credit score rating restore is an involved course of. Nonetheless listed below are the basics:

Know your rights under the laws

The Sincere Debt Assortment Practices Act is a federal laws that limits what collectors can do to assemble cash owed, and is run by the Federal Commerce Price.

As an example, it limits when a creditor can title you, and prohibits them from making threats. Merely understanding your rights under this laws can go a fantastic distance in direction of taming a hostile creditor.

Get a replica of your latest credit score rating report

It’s most interesting to have one from each of the three bureaus, TransUnion, Equifax and Experian. Information can appear on one which isn’t on the others. Overview each report, and highlight any damaging entries.

Seek for errors

Many credit score rating research embody errors, usually of the damaging choice. In case you uncover any, you’ll should contact the three credit score rating bureaus and open a dispute. The credit score rating bureaus will look at the entry, and if it’s not yours, they’re required to remove it by laws.

Usually you may should dispute an merchandise straight with the creditor. In case you do, you’ll need to jot down a cover letter that summarizes the dispute, and join any supporting documentation. Nonetheless be warned that in case you don’t have any documentation to assist your declare, the creditor may not take away the merchandise.

Reverse to what you may have heard or be taught, it’s normally not doable to get damaging credit score rating data eradicated with out laborious proof.

Time Heals All Credit score rating Wounds – In the end

This pertains to the damaging credit score rating data which you can’t take away. That may embrace public data and derogatory credit score rating data the place you may be really at fault. Nonetheless even when that’s the case, all isn’t misplaced.

The one profit you can have working in your favor with credit score rating points this time. The additional time that passes between the damaging credit score rating event and at current, the a lot much less affect it’ll have in your credit score rating ranking.

As an example, a late charge from 5 years prior to now has a lot much less affect than one from six months prior to now. And eventually, the entire damaging data will fall off your credit score rating report in its private time. That’s normally between seven years and 10 years, counting on the derogatory data.

Do what you can to remove as loads damaging data out of your credit score rating report as doable. If there is a late stability or a set account that you just simply do owe, pay it immediately. Even if the damaging merchandise will keep in your credit score rating report for numerous years, a paid account is always greater than a late or a set.

And as described earlier, pay your entire obligations on time any longer, and systematically work in order so as to add new, constructive credit score rating to your report. As your constructive credit score rating builds, and time passes, the damaging stuff will lastly go away.

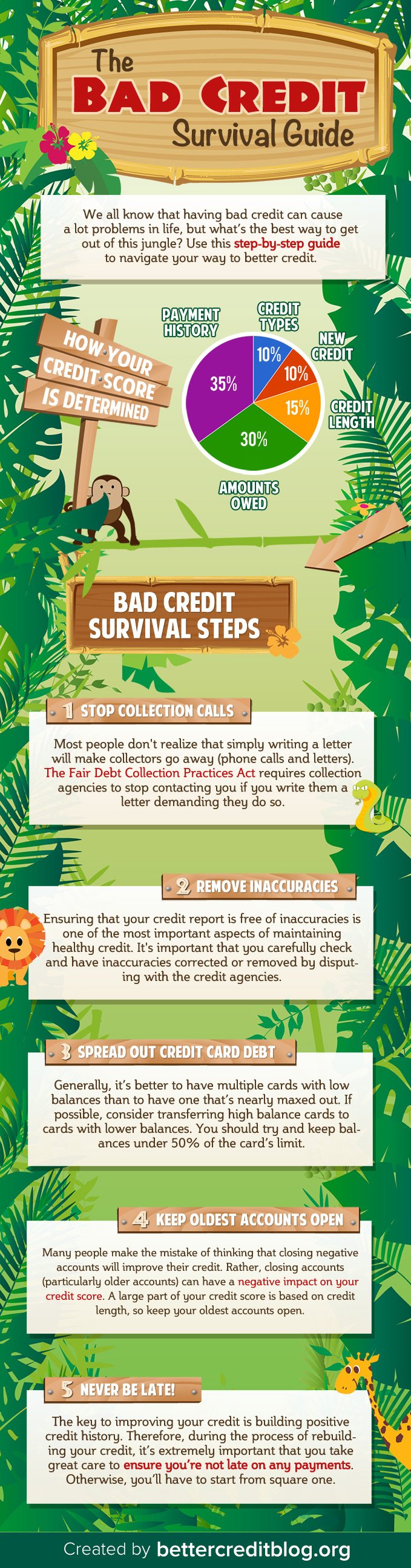

A Info to Repairing Your Credit score rating

We’ve summed up our biggest credit score rating restore strategies into an infographic. Proper right here’s our very poor credit survival data:

On this text, we’ve launched a high-altitude view of the credit score rating restore course of.

It might be fairly straightforward in case you solely have a little bit of little little bit of very poor credit, in any other case you’re merely searching for to boost your ranking. Nonetheless it could be amazingly troublesome you most likely have a protracted historic previous of very poor credit.

That’s when it’s advisable to call throughout the professionals, like credit score rating restore companies and stay away from making any further errors to hurt your credit score rating any further.

Nonetheless look at once more with us usually. We’ll be growing on each of these issues going forward.

If in case you may have concepts of going the DIY path to credit score rating restore, you gained’t must miss any of them.

Related posts

Subscribe

* You will receive the latest news and updates on your favorite celebrities!

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating