Charges of curiosity have fallen all through the lending spectrum, along with mortgages. Earlier this spring mortgage fees reached their lowest degree ever. These low fees moreover apply to the VA dwelling mortgage program.

If you’re eligible for a VA dwelling mortgage, now is a superb time to reap the advantages of those low fees, each to purchase a home with no down charge or to refinance your current mortgage through the simplest VA lenders.

You’ll apply for a VA mortgage mortgage through any lender that participates inside the VA dwelling mortgage program. Nonetheless some lenders originate VA loans solely typically which suggests they’re solely minimally conscious of the principles.

For that motive, it is advisable focus your efforts on the mortgage lenders specializing in VA loans and may make the strategy as simple as potential.

The 7 Best VA Mortgage Lenders

Listed below are among the finest VA mortgage lenders:

- Veterans United

- Veterans First

- Quicken Loans

- Rocket Mortgage

- Navy Federal Credit score rating Union

- USAA

- PenFed Credit score rating Union

Veterans United Dwelling Loans

Veterans United Dwelling Loans is crucial VA mortgage lender inside the nation. This VA mortgage specialist operates in all 50 states, so you could work with this agency no matter the place you may be stationed or reside. You’ll begin the mortgage utility course of each on-line or by cellphone.

Veterans United even engages the businesses of former senior enlisted leaders from each division of the armed corporations to help data you on the exact mortgage requirements for energetic duty navy personnel.

Veterans United moreover gives quite a few helpful packages to help deal with your own home purchasing for experience. This lender can current direct assist all by way of your own home purchasing for course of through a neighborhood of precise property brokers who concentrate on working with veterans.

Research Additional: Be taught our full Veterans United Dwelling Loans Consider.

Consider Prices

Veterans First Mortgage

![]()

Veterans First Mortgage is one different most important lender specializing in VA loans. Nonetheless moreover they provide FHA loans, which will even be important to veterans. If for any motive you’re unable to qualify for a VA mortgage, an FHA mortgage could very nicely be a viable Plan B.

Veterans First has been a VA lender since 1985 which provides this lender a wealth of experience dealing with these extraordinarily specialised loans.

You’ll be assigned a VA mortgage specialist who will work with you through the whole course of — from getting your Certificates of Eligibility to closing in your mortgage, making the experience further stress-free. You merely can’t uncover this diploma of service with most private lenders.

Any such help will likely be notably important to first-time dwelling customers who need extra guidance with their mortgage functions.

Quicken Loans

Quicken Loans is crucial mortgage originator within the US, working all by way of the nation. Quicken is simply not a VA mortgage specialist however it writes enough dwelling loans to have quite a few experience with the VA mortgage program.

Together with providing VA loans, Quicken Loans moreover gives all completely different sorts of mortgages, along with typical, FHA, Jumbo, and USDA loans.

This availability of various mortgage kinds may be very important in case your navy service doesn’t qualify for a VA mortgage, or if a VA mortgage gained’t fit your mortgage desires. For example, in case you need financing for a visit dwelling or an funding property, you’ll need a conventional mortgage. A lender that gives solely VA loans won’t be prepared that can assist you to with that kind of purchase.

Quicken Loans moreover fees very extraordinarily for buyer assist, and has the good thing about servicing the loans it originates. Which means you’ll be making your funds on to the equivalent agency.

Research Additional: Be taught our full Quicken Loans Consider.

Consider Prices

Rocket Mortgage

Rocket Mortgage is part of Quicken Loans, serving as its on-line mortgage lending arm. Rocket gives all the advantages of Quicken Loans, nevertheless gives the consolation of an all-online course of.

This suggests there’s no wish to fulfill with a mortgage officer face-to-face. Your whole course of will likely be achieved on-line, along with importing your paperwork. This may increasingly lead to fast approvals and closings inside a lowered time frame.

Like Quicken Loans, Rocket Mortgage moreover originates quite a few VA loans along with completely different mortgage kinds.

Research Additional: Be taught our full Rocket Mortgage Consider.

Consider Prices

Navy Federal Credit score rating Union

Not like the sooner 4 lenders on this guidelines, Navy Federal Credit score rating Union serves solely navy members which suggests its mission aligns fully with the U.S. Division of Veterans Affairs which regulates the VA dwelling mortgage program.

Not like the sooner 4 lenders on this guidelines, Navy Federal Credit score rating Union serves solely navy members which suggests its mission aligns fully with the U.S. Division of Veterans Affairs which regulates the VA dwelling mortgage program.

You’d should affix Navy Federal sooner than making use of for a mortgage, nevertheless service members from any division qualify for membership. Safety contractors and even some Division of Safety civilian employees may additionally be part of.

If you’ve joined, you’ll have entry to quite a few the bottom fees on the market. And likewise you’ll get educated guidance through the borrowing course of.

Navy Federal has 15- and 30-year time interval VA loans. This lender moreover considers numerous borrowing requirements in case your credit score rating historic previous doesn’t preserve up. For example, you’ll get credit score rating for making on-time lease funds for the last few years even in case you don’t pretty meet the minimal credit score rating score. Take into consideration your fee of curiosity would probably enhance.

USAA

This military-only affiliation started out as an auto insurance coverage protection provider and has steadily grown, rising into banking and mortgages. Naturally, the VA dwelling purchase program matches inside USAA’s safe of merchandise.

This military-only affiliation started out as an auto insurance coverage protection provider and has steadily grown, rising into banking and mortgages. Naturally, the VA dwelling purchase program matches inside USAA’s safe of merchandise.

Solely energetic duty navy members and veterans may be part of USAA. Whereas it serves members in all 50 states and stationed across the globe, USAA has solely a handful of bodily locations of labor. You’d entry this lender’s mortgage merchandise on-line or over the cellphone.

USAA would not provide FHA or USDA loans. You moreover gained’t uncover a dwelling equity line of credit score rating. Better than half of this financial institutions mortgage loans are backed by the U.S. Division of Veterans Affairs which suggests you’ll be working with an actual VA mortgage specialist.

If you’re refinancing a VA dwelling mortgage in hopes of getting a lower charge, USAA gives a stunning mannequin of the VA streamline (IRRRL) refinance. USAA gained’t price an origination worth for this refinance mortgage.

PenFed Credit score rating Union

PenFed — transient for Pentagon Federal — Credit score rating Union moreover focuses on VA purchase mortgage selections for U.S. navy members and veterans.

PenFed — transient for Pentagon Federal — Credit score rating Union moreover focuses on VA purchase mortgage selections for U.S. navy members and veterans.

Like Navy Federal and USAA, you’d wish to affix PenFed sooner than making use of for a mortgage. Nonetheless membership has its privileges which embrace aggressive charges of curiosity and a clear mortgage course of.

PenFed has one of many very important open enrollment insurance coverage insurance policies of any military-based credit score rating union. Safety contractors along with energetic duty service members and veterans from any division may be part of PenFed. Civilian employees of the DoD may be part of. Even volunteers inside the American Crimson Cross may be part of.

Nonetheless solely navy members and veterans can get a VA dwelling mortgage. Totally different members can get a home equity line of credit score rating, a jumbo mortgage for a extreme steadiness mortgage, or a standard mortgage or refinance.

What Is A VA Mortgage?

VA loans are a selected program created by the US authorities and managed by the Division of Veterans Affairs. They exist to help eligible energetic duty members of the navy, along with veterans, buy protected and cheap housing.

VA lenders help you get a model new dwelling mortgage with no down charge and no private mortgage insurance coverage protection premiums. We’ll uncover these benefits inside the subsequent half beneath.

VA purchase loans or refinance loans can go to members from any division of the navy, along with the Army, Navy, Air Drive, Marines, Coast Guard, the Nationwide Guard and the Reserves.

VA loans aren’t actually made by the Veterans Administration. As a substitute, the loans are provided by private institutions, like banks and mortgage firms on my guidelines above. Mortgage insurance coverage protection is provided by the VA which provides the mortgage program its title.

That mortgage insurance coverage protection acts as an inducement for lenders to make loans to eligible veterans. The insurance coverage protection lets lenders worry a lot much less regarding the losses they might preserve from foreclosures, opening the door to further favorable lending phrases for veterans.

What Are The Benefits of a VA Mortgage?

VA loans have many benefits, a number of of which are distinctive to this express mortgage sort:

- No down charge requirement: As a lot as positive very generous mortgage limits, VA loans provide 100% financing. That’s strong to hunt out elsewhere inside the mortgage market.

- No month-to-month mortgage insurance coverage protection (PMI) premium: Every typical and FHA mortgages require some kind of borrower-paid mortgage insurance coverage protection. VA loans don’t. As a substitute, you’ll pay an upfront mortgage insurance coverage protection premium that’s added to your mortgage amount and financed over the time interval of the mortgage. This may increasingly finish in a lower month-to-month house charge than you could in every other case have.

- Vendor-paid closing costs: VA permits property sellers to pay closing costs equal to as quite a bit as 4% of the mortgage amount/purchase value. Since closing costs generally frequent between 2% and 4%, you’ll steer clear of paying out of pocket for closing costs. Along with the 0% down charge requirement, VA loans are true 100% financing preparations.

- Charges of curiosity on VA loans are generally lower: The pace profit on this mortgage program may be small — perhaps solely 0.125% or 0.25%. Nonetheless it’s going to nonetheless finish in exactly lower mortgage funds than would in every other case be the case.

How Do VA Loans Work?

VA loans have quite a few “shifting parts. Each is described beneath:

Mortgage Varieties and Phrases

VA loans may be present in phrases ranging from 15 to 30 years. They’re moreover accessible in every fixed-rate and adjustable-rate mortgages (“ARMs”).

As a result of the title implies, a tough and quick charge mortgage has a tough and quick fee of curiosity and glued month-to-month mortgage charge all by way of the time interval of the mortgage.

An adjustable charge mortgage will generally embody a tough and quick charge and glued month-to-month charge for the first 5 years, then modify yearly thereafter. The model new charge and charge will likely be each elevated or lower than the preliminary charge and charge.

Nonetheless to limit how quite a bit debtors pays on an ARM, the VA “caps” the mortgage. With a VA mortgage, the pace can enhance by no more than 1% in anybody 12 months, or 5% over the lifetime of the mortgage.

For example, in case your preliminary charge is 3%, the perfect the pace will likely be after the first adjustment is 4%. Over the lifetime of the mortgage, the utmost fee of curiosity will doubtless be 8% (3% + 5%).

Whether or not or not you take a fixed-rate or adjustable-rate mortgage, the mortgage will doubtless be totally paid off on the end of the mortgage time interval.

VA Funding Cost

FHA mortgages require mortgage insurance coverage protection that options every an upfront worth (that’s generally added to your mortgage mortgage steadiness), and a month-to-month premium that’s part of your new month-to-month charge. Typical mortgages have private mortgage insurance coverage protection (PMI), which gives a month-to-month premium to your personal house charge, nevertheless would not require an upfront amount.

The VA imposes a “Funding Cost”, which is an upfront price added to the mortgage amount and financed over the time interval of the mortgage if essential. There is not a month-to-month mortgage insurance coverage protection premium.

The intention of mortgage insurance coverage protection is to provide assurance to the mortgage lender that on the very least part of the mortgage will doubtless be reimbursed upon foreclosures.

Throughout the case of VA loans, the Veterans Administration insures 25% of the mortgage amount. If you default on a $200,000 mortgage, the VA pays the lender $50,000. Presumably, the remaining $150,000 will doubtless be coated out of the proceeds of the sale of the property.

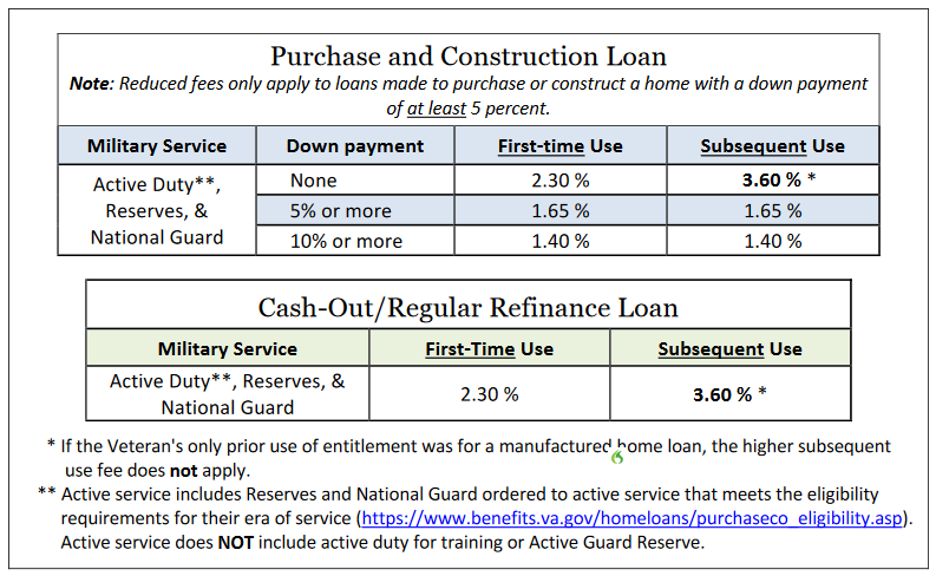

The amount of the VA Funding Cost will depend on the sort of mortgage, the amount of the down charge made, and whether or not or not it’s a major time for the following use of your VA eligibility:

Most Mortgage Amount

Technically speaking, there’s not a most VA mortgage amount. Nonetheless, to get 100% financing, the utmost mortgage amount ranges between $510,400 and $765,600, counting on the county the place the property is being purchased.

These limits will apply solely to veterans with quite a few glorious VA loans, or to those who have defaulted on a earlier VA mortgage.

Nonetheless in case you nonetheless have your full entitlement, and likewise you’ve under no circumstances defaulted on a earlier VA mortgage, the mortgage amount will likely be as extreme as a lender is eager to grant. Nonetheless, in case you do exceed these limits, you’ll should offer you 25% of the excellence as a down charge.

For example, let’s say the property you’re shopping for is positioned in a county with a $600,000 mortgage limit. You should buy a property for $800,000, nevertheless you’ll should make a $50,000 down charge.

The $50,000 is 25% of the $200,000 that the acquisition value will exceed the $600,000 county limit.

Mortgage portions in further of the revealed county limit are generally called VA Jumbo loans.

Eligible Property Varieties

Eligible property kinds for a VA mortgage are restricted to 1 to 4 family residential properties that can doubtless be owner-occupied each by the veteran or a member of the veteran’s on the spot family.

Not like typical mortgages, VA loans aren’t accessible for financing journey properties for funding properties.

All properties ought to meet minimal native necessities for safety and livability, along with right functioning of the primary components of the home.

Recommendations on find out how to Qualify for a VA Mortgage

Whereas VA loans are notably designed for eligible energetic duty and retired members of the navy, each borrower may wish to qualify primarily based totally on his or her private deserves. Numerous components go into this willpower.

Eligibility

Eligibility begins with the Certificates of Eligibility (COE). If you don’t have it accessible, your lender must be able to assist you to in buying this certificates from the Division of Veterans Affairs. The COE should be accessible for those who weren’t dishonorably discharged, and likewise you meet the minimal energetic duty service requirement primarily based totally on everytime you served.

You’ll check the eligibility requirements straight with the Veterans Administration, nevertheless beneath are the most common situations:

- You’re eligible in case you will have been on energetic duty for on the very least 90 regular days.

- If you served between 1980 and August 1, 1990, you’ll need 24 months or on the very least 181 days on energetic duty.

- Between August 2, 1990 and the present, on the very least 90 days of energetic duty, or on the very least 90 days of your discharge for a hardship, low cost in drive, or for consolation of the federal authorities, or decrease than 90 days in case your discharge is for a service-connected incapacity.

Completely completely different service requirements apply to earlier time intervals.

Credit score rating Ranking Requirements

VA loans have no mentioned minimal credit score rating score requirements. Nonetheless, most lenders impose a minimal FICO credit score rating score requirement of 620. Some will make loans to eligible veterans with lower scores, nevertheless will price the following fee of curiosity within the occasion that they do.

Exactly how extreme the pace will doubtless be will rely in your credit score rating report and completely different particulars of your normal {{qualifications}}.

Debt-to-Earnings (DTI) Requirements

Sometimes speaking, VA loans are permitted with a debt-to-income ratio of as a lot as 43%. Debt-to-income ratio (DTI) is calculated by dividing your full mounted month-to-month debt funds by your safe month-to-month income.

Mounted month-to-month funds embrace your proposed month-to-month house charge, plus month-to-month funds for auto loans, pupil loans, financial institution playing cards, child help, alimony, and completely different recurring funds.

This ratio would not embrace funds for utilities, insurance coverage protection premiums (along with medical medical insurance), retirement contributions, and completely different variable or non-compulsory month-to-month costs.

In case your normal credit score rating qualification is highly effective, the lender might permit a debt-to-income ratio of as a lot as 50%, nevertheless that may enhance the speed of curiosity you’ll pay in your mortgage.

In unusual circumstances, a DTI exceeding 50% may be permitted, nevertheless it’s going to finish in a wonderful elevated fee of curiosity and month-to-month mortgage charge. The lender also can require sturdy compensating components, akin to creating a down charge, a decrease out of your earlier house charge, or a substantial quantity of monetary financial savings after closing.

Cash Requirements

Since VA loans require no down charge as a lot because the county most mortgage limit, and shutting costs will likely be paid by sellers, homebuyers may need no money up entrance the least bit.

It is potential you will need cash out of pocket if:

- the seller refuses to pay your closing costs as a lot because the 4% of the mortgage amount allowed by the VA.

- the acquisition value of the property you’re purchasing for exceeds the utmost county mortgage limit, requiring you to offer you a down charge equal to 25% of the excess amount.

In most completely different situations, it is advisable be able to purchase a home with no cash upfront in anyway.

Components Affecting VA Mortgage Curiosity Prices

Base charges of curiosity for VA loans are determined by market charges of curiosity. Mortgage fees, typically, are primarily based totally on the 10-year U.S. Treasury discover. That charge serves as a base, and a margin is added to it to compensate the bondholders who lastly fund the loans.

Nonetheless aside from the market-driven base charge, there are a variety of components that may impact the pace you’ll pay. A number of of those components have been talked about inside the above half, nevertheless we’ll guidelines them as soon as extra proper right here:

- Mortgage amount: Loans beneath $250,000 will embrace a slight charge enhance, as will loans that exceed the native county limit.

- Credit score rating historic previous: The pace you see revealed by any lender will probably be for any individual with a credit score rating score of 700 or elevated. Lower scores will finish in elevated fees.

- Debt-to-income ratio: A DTI higher than 43% could enhance your charge.

- The dimensions of your charge lock: The longer your charge lock, the higher your mortgage charge. Often you lock in a charge alongside together with your preapproval which provides you time to purchase a home with out worrying a number of charge enhance.

- Lender-paid closing costs: If a vendor gained’t pay some or your whole closing costs, your lender might pay them in alternate for a barely elevated fee of curiosity.

- The time interval of your mortgage: 30-year loans have elevated fees than 15-year loans. The 15-year risk requires elevated month-to-month mortgage funds nevertheless costs a lot much less in full curiosity paid all by way of the lifetime of the mortgage.

Are VA Mortgage Prices Completely completely different Between Purchases and Refinances?

The VA gives a novel refinance program generally known as the Curiosity Worth Low cost Refinance Mortgage, or simply IRRRL. The profit with this mortgage is that it requires a lot much less documentation.

For example, since you’re altering an current VA mortgage on which you may be already making funds, the lender gained’t affirm your credit score rating, employment or income. They may not even perform a property appraisal.

Because of the simplicity of IRRRLs, fees are generally lower than completely different mortgage kinds, along with VA loans for purchases. What’s further, the VA Funding Cost on IRRRLs is just 0.5%, which is lower than the worth for various VA mortgage kinds. And since documentation is very restricted, you could full an IRRRL in moderately quite a bit a lot much less time than it’s going to take for a purchase order order mortgage.

A significant facet with an IRRRL is that you just cannot use it for a cash-out refinance that can faucet your own home’s equity. You’re merely altering the current VA mortgage with a model new one with a lower fee of curiosity. Nonetheless, this method does allow you so as to add mortgage closing costs to the model new mortgage amount.

To do an IRRRL you need to be refinancing an current VA mortgage. Typical and FHA mortgages aren’t allowed. You moreover cannot have a number of 30-day late charge in your current mortgage contained in the earlier 12 months. The pace on the model new mortgage ought to be lower than your current charge, till you may be refinancing from an ARM to a fixed-rate mortgage. The property ought to moreover proceed to be your main residence.

What for those who want an exact cash out refinance? To get cash out of your own home’s equity you’d need a conventional or FHA mortgage. You probably can moreover get a home equity line of credit score rating from a typical monetary establishment or credit score rating union to entry your saved up dwelling value.

Is A VA Mortgage Best For You?

VA loans are certainly one of many excellent mortgage kinds accessible. If you’re an eligible veteran or energetic duty member of the navy, it is advisable fully reap the advantages of this program to your dwelling financing desires. Get your pre-approval from an expert VA lender at the moment to begin out your mortgage course of.

Related posts

Subscribe

* You will receive the latest news and updates on your favorite celebrities!

Recent Posts

- How To Take away A Chapter From Your Credit score rating Report

- Strategies to Improve Your Credit score rating Score by 100 Components FAST

- The way in which to Take away Value Offs From Your Credit score rating Report

- 3 Strategies to Take away a Foreclosures From Your Credit score rating Report

- Assured Unsecured Credit score rating Taking part in playing cards for People with Harmful Credit score rating